XRP was one of the first cryptocurrencies, founded in 2012, three years after Bitcoin’s launch. The XRP token serves as a payment and settlement currency for the XRP Ledger blockchain and is now used by Ripple, a global payment service provider. Over the years, XRP has developed a loyal following in the crypto community, but is XRP a good investment today?

In this guide, we’ll explore the XRP ecosystem, the regulatory landscape, and how XRP is being used in real-world financial transactions. If you were wondering, “Should I buy XRP?” it’s important to take a balanced view, weighing the pros and cons. Let’s find out what lies ahead for this cryptocurrency.

How Has XRP Performed as an Investment?

When XRP launched in August of 2012, the tokens were priced at $0.01. By early 2018, XRP reached an all-time high of $3.84. However, the highs wouldn’t last. Following the bidding frenzy, XRP fell, spending much of 2019 and 2020 trading between $0.20 and $0.60.

The return of the crypto bull market in 2021 sent XRP soaring again, although it never reached its previous highs, topping out at just under $2.00 per XRP. The battle to regain $1.00 became a meme within the crypto community during XRP’s downtrends. However, the earliest investors fared well, seeing gains of 1,900% up to 38,300% at the peak.

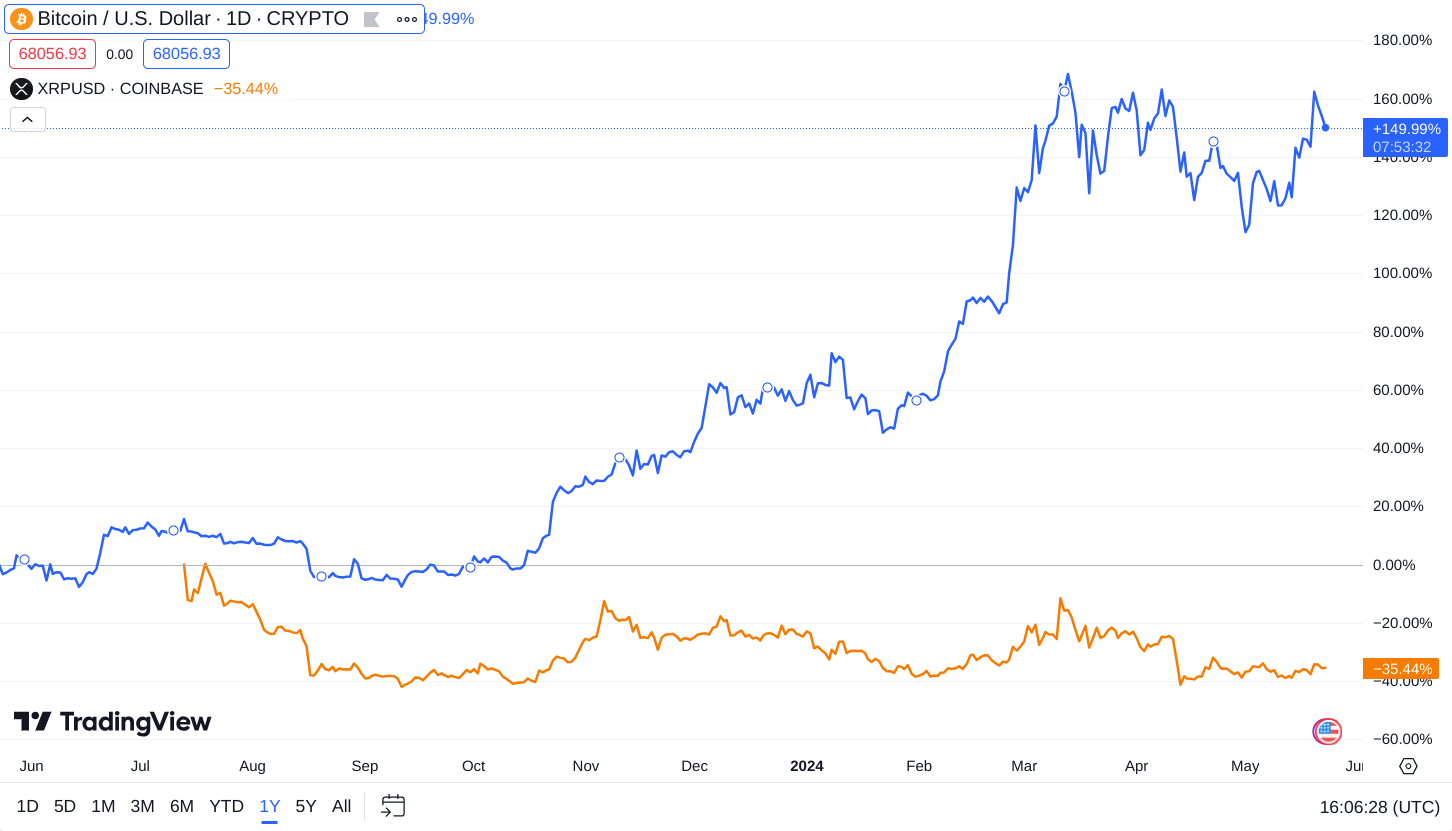

Looking at more recent history, XRP hasn’t fared as well against other leading cryptocurrencies despite its top-ten market capitalization. A 12-month price history shows Bitcoin gaining 149%, whereas XRP has lost 35%.

XRP Price History Timeline

Similar to other cryptocurrencies, XRP has seen parabolic growth but fell hard from its peaks. However, XRP’s all-time high came in 2018 rather than 2021, as was the case for Bitcoin, Ethereum, and Cardano, other top-ten cryptocurrencies.

- 2014: XRP launched at $0.01. XRP later fell below this price, dipping to 0.006396 in 2017. Pricing remained relatively flat until later in 2017, although traders played the swings too small to see on the chart.2

- 2017: March of 2017 marked the beginning of the first big runup for XRP. By May of 2017, XRP peaked at $0.45, posting a nearly 4,000% gain in less than three months.3

- 2018: After a brief cooldown from the May runup, XRP went parabolic, reaching an all-time high of $3.84.4

- 2020: Following a sell-off that was as fast and furious as its ascent, XRP bottomed in the 10-cent range.5

- 2021: The crypto bull market of 2021 brought renewed buying pressure, pushing XRP up to $2.00 briefly.

- 2024: XRP fell throughout the bear market of 2022 and 2023, beginning to climb again in mid-2023.

Generally, XRP’s price action followed the broader cryptocurrency market’s moves, including Bitcoin and Ethereum. However, XRP didn’t always enjoy the same level of exuberance. During the 2021 bull run, XRP faced legal challenges. The US Securities and Exchange Commission (SEC) filed charges against Ripple in December 2020, casting doubt on the XRP token used by Ripple.

XRP Price Forecast

Is Ripple a good investment? CryptoNews analysis gives an XRP price prediction as high as $0.91 by year-end 2024, an 80% increase from XRP’s current 50-cent range.

XRP Price Forecast 2024

Our month-by-month forecast shows little risk of downside from the current price. However, gains could be slow. Meaningful price appreciation for XRP may not begin until June 2024. Prices could begin to creep up in the following months, reaching an expected year-end range of $0.662 to $0.914. Our XRP price prediction calls for an average price of $0.823 at the close of 2024.

XRP Price Forecast 2025

By 2025, prices for XRP could get more interesting. On the low end of our projection, XRP could reach $1.82. On the high end, XRP could reach its 2021 highs, climbing as far as $2.11. We anticipate an average price of $1.95 by year-end 2025, with prices climbing throughout the year during the expected bull market.

XRP Price Forecast 2030

Longer-term investors may see more impressive gains. While the low end of the 2030 forecast parallels the projection for 2025, the high end could see XRP passing the $3.00 mark convincingly. Optimistically, XRP’s price might reach $3.60 on the top end for 2030, close to its all-time high in 2018. In the lower range, we see a price prediction of $1.87, with an average price of $2.67 by 2030.

In the short term, Ripple’s ongoing court battle with the SEC is expected to keep prices constrained despite forging new markets. As the crypto market gains clarity on the direction of the court case, XRP’s price can rise without the headwinds it faces now. Additionally, many in the industry expect crypto markets to surge in 2025, pushed ahead by 2024’s Bitcoin halving and increasing adoption.

Is XRP a Good Long-Term Investment?

The XRP Ledger (XRPL) exists independently of Ripple Labs. However, because Ripple is so deeply intertwined with XRP, it’s also essential to consider its role when weighing an XRP investment. XRPL gifted Ripple 80% of the XRP supply, with 55% held in a locked escrow. The escrow allows up to one billion tokens per month to be released, or one percent of the total 100 billion XRP supply. The move was intended to create price stability.

While XRP’s circulating supply can increase from Ripple’s released holdings (the one billion XRP represents an upper limit), XRP is also burned in transactions. To date, about 12 million XRP have been burned, meaning that these tokens are removed from circulation forever.

According to Ripple’s 1st quarter 2024 markets report, the average cost of transactions dropped by 44% while the number of transactions increased by 100%, quarter over quarter. The number of XRP burned in transactions also increased, doubling since Q1 2023 to 636,000.

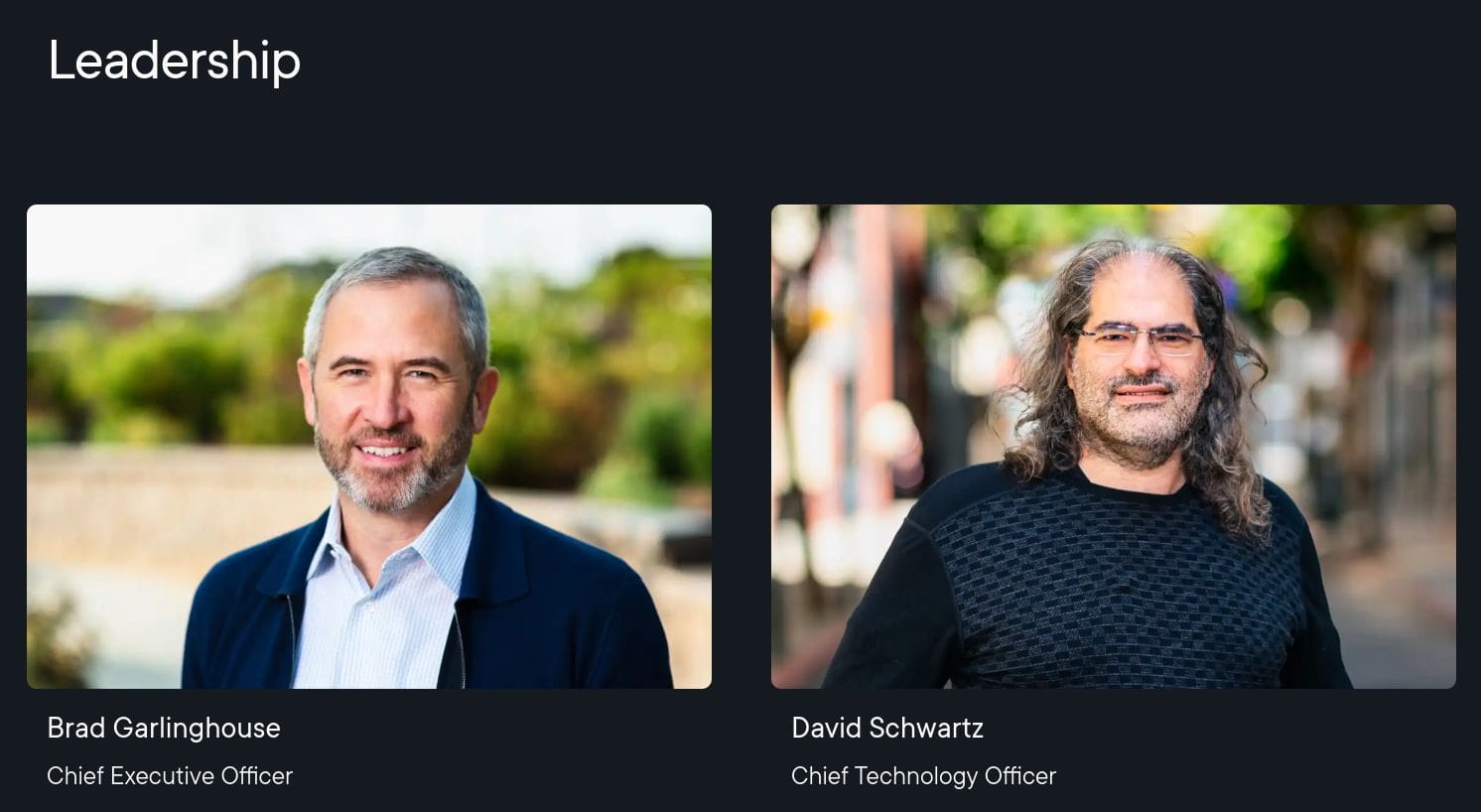

Strong and Experienced Leadership

XRP’s story began in 2011, when Jed McCaleb, David Schwartz, and Arthur Britto began the development of the XRP Ledger with XRP as the native token. By 2012, the network was live. The project initially shared similar goals to Bitcoin, enabling fast transactions globally.

The original open-source project was named Ripple and was the namesake of Ripple Labs, the company that would arise around and from the XRP Ledger. Ripple was originally named OpenCoin before rebranding in 2013. Jed McCaleb of XRP and Chris Larsen founded the company in 2012.

Ripple CEO Brad Garlinghouse is a driving force behind Ripple’s growth and makes frequent appearances on financial broadcasts to educate investors on XRP and Ripple’s network built on XRPL. David Schwartz, a founder of XRP and an industry icon, is the company’s CTO. Chris Larsen, a Ripple co-founder, still serves on the board of directors.

While XRPL and Ripple are distinct entities, the deep links between them remain, and some of the earliest pioneers of the crypto industry help guide both Ripple and XRP forward.

Expanding Partnerships and Use Cases

Through Ripple, XRP is being used in real-world applications as a payment and settlement asset. Fast transaction times and low fees make it possible to transfer money anywhere in the world in seconds. Compared to the legacy SWIFT system, which can take up to five days, XRP-powered transactions are much more efficient. This value proposition isn’t lost on Ripple’s rapidly growing list of partners. Litigation in the US has led to an international focus.

- Central Bank of Colombia: Ripple’s CBDC platform, which is based on the XRP Ledger, has captured the interests of governments. Ripple partnered with Columbia’s central bank in 2023 to explore the use cases of blockchain technology.

- SBI Remit: Since 2017, Japan’s SBI Remit has used XRP as a bridge asset facilitated by Ripple Payments.

- QNB Qatar National Bank: Cross-border payments through RippleNet are fast and inexpensive. QNB began working with Ripple in 2021.

- Travelex Bank: Brazil’s Travelex Bank partnered with Ripple to optimize cross-border payments in 2023.

Ripple’s reach spans dozens of other financial institutions and service providers worldwide. XRP Ledger can also host other compatible tokens, making the platform well-suited to the tokenization of real-world assets.

Energy-Efficient Transaction Validation

Unlike Bitcoin’s proof of work or Ethereum’s proof of stake consensus mechanisms, Ripple uses trusted nodes to validate transactions. This streamlined structure helps the network achieve its fast transactions with minimal energy consumption.

XRP’s 100 billion tokens were pre-mined. Unlike Bitcoin, its primary competing cryptocurrency at launch, no additional energy is required for mining new coins. Instead, no new XRP tokens will be issued, with the cap fixed at 100 billion. XRP’s supply is deflationary because fees on the network are burned (removed from circulation).

Regulatory Status

Despite Ripple’s legal challenges with the SEC, XRP is in a unique position within the crypto space. In 2023, a judge ruled that XRP tokens sold on secondary markets do not constitute the sale of securities.

However, the ruling represents a partial victory in an ongoing battle with regulators. Initial tokens sold directly to investors did represent the sale of securities (an investment contract), according to the ruling. This ruling cleared the way for trading XRP on crypto exchanges, many of which had culled XRP from their offerings.

The case is still ongoing, with many aspects still open to appeal. Additionally, the ruling regarding XRP’s status as a security in initial direct sales leaves Ripple in the SEC’s hot seat. The SEC has since sought fines and penalties amounting to $2 billion for the early sales to institutional investors. The case is ongoing and could impact the entire industry. Many projects share a similar structure, with some tokens sold to early investors before reaching exchanges.

What Does The Future Hold For XRP?

XRP’s future hinges on increased adoption. While Ripple is working to forge new relationships with major financial institutions, service providers and governments, the ongoing court case casts a shadow in markets like the US.

XRP Ledger’s ability to host additional compliant tokens and a functional decentralized exchange bodes well for growth in the use cases for XRP and XRPL. Much like Ether (ETH) powers the transfer of NFTs and tokens on the Ethereum blockchain, XRP powers transactions on XRPL. Newer applications like real-world crypto assets could push a well-connected blockchain like XRPL to the top. A global network of financial institutions already working with Ripple provides a wealth of opportunities to use XRP and XRPL in new ways.

What Experts Say on Whether You Should Buy XRP

Is XRP worth buying? The industry still holds mixed opinions on XRP and its role in the digital asset space. On the one hand, the deep links to Ripple give the XRP brand awareness superior to most cryptocurrencies. On the other hand, the ongoing legal saga involving Ripple and US regulators creates short-term uncertainty and will likely hold prices down in the near term.

Many earlier price predictions for XRP missed the mark by miles, showing how difficult it can be to predict digital asset prices in a rapidly changing market. In the end, the market decides. A Binance user survey indicates that the market sees XRP’s future price as largely unchanged throughout 2024 and 2025. By 2030, respondents see the token trading at $0.70.

Other analysts put the potential market price much higher, however.

- AMBCrypto sees XRP possibly reaching $1,26 by year-end 2024. Longer-range predictions put the token as high as $80 by 2030. However, this would mean an $8 trillion market cap. In context, BTC’s fully diluted market cap is just over $1.4 trillion.

- Changelly’s panel predicts XRP could reach $0.79 in 2024, with a high target of $7.54 by 2030.

It’s important to note that Ripple’s payment systems aren’t dependent on the price of XRP. Payments are settled nearly instantaneously in local currencies, whether XRP is $0.50 or $50.

Conclusion – Is Ripple a Good Investment?

XRP’s loyal following and the deep ties with Ripple’s global partnerships help keep XRP in the news and near the top of the crypto charts in market capitalization. A fixed supply of tokens with built-in deflation due to burning fees provides an attractive investment opportunity for those concerned about inflationary tokens. However, it’s also important to weigh the previous performance as well as the legal challenges faced by Ripple. If Ripple comes out on top, XRP could rally. If not, prices could suffer.

As always, never invest more than you can afford to lose. If you decide to invest in cryptocurrencies, consider building a diversified portfolio to protect against downside risks in any specific asset.

FAQs

Can XRP hit $10?

Some experts have predicted a $10 price or higher for XRP. However, at a $10 market cap, XRP would have a $1 trillion market cap. This figure approaches BTC’s market cap and doubles Ethereum’s current market cap.

How high can XRP realistically go?

CryptoNews analysis sees XRP’s price potentially reaching $0.82 in 2024, with a longer-term maximum price of $2.67 possible by 2030.

How much will 1 XRP be worth in 2030?

Analyst estimates for XRP’s price by 2030 range from $2.67 to as high as $80.

What makes XRP a better investment than other cryptocurrencies?

XRP is used by financial institutions in real-world transactions. Ripple, a company built around XRP, uses XRP as a settlement asset for cross-border transactions. XRP also offers a fixed supply of 100 billion tokens, most of which are locked in escrow to be released slowly.

References

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.