Leon Neal

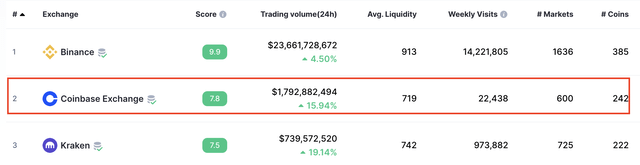

Coinbase (NASDAQ:COIN) is the second most popular crypto exchange in the world (by daily trading volume) and the most popular in the U.S. (see below table).

Crypto Exchange Volume (CoinMarketCap)

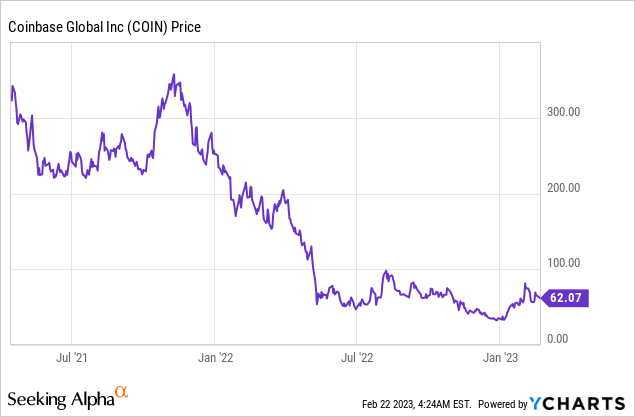

The company has faced a tough time since crypto prices imploded in the first quarter of 2022, and went on a “death spiral” downwards, which was only exacerbated by the collapse of FTX (FTT-USD). However, Coinbase is actually still in a solid leadership position and the business has recently announced better-than-expected results for the fourth quarter of 2022, beating both revenue and earnings growth estimates. In this post, I’m going to break down its recent quarterly results in granular detail, before diving into my valuation model and forecasts for the company. Let’s dive in.

Mixed Fourth Quarter Results

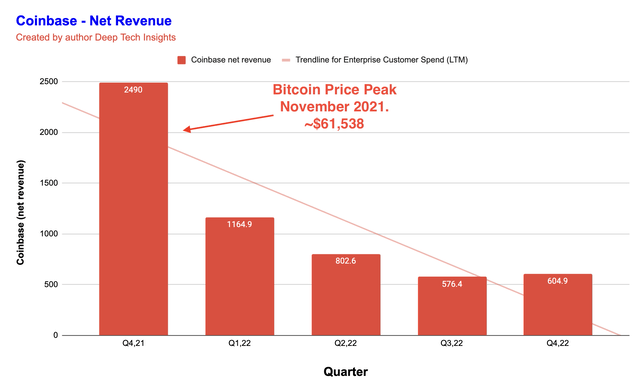

Coinbase reported mixed financial results for the fourth quarter of 2022. Its revenue was $605 million, which surprisingly increased by 5% quarter over quarter and was better than analyst expectations of $590 million, according to Refinitiv data. However, if we zoom out, the picture isn’t so rosy. Its net revenue has actually declined by an eye-watering 75.7% year over year. Of course, management didn’t include a revenue chart of this decline in its earnings report. Therefore many investors may have overlooked this, thus I have created a chart below. As you can see the peak in net revenue (Q4 ’21) coincides with the peak in the price of Bitcoin (BTC-USD) in November 2021, at ~$61,538 per Bitcoin. This was before the price of Bitcoin plummeted by 71.5%, by the end of Q4 ’22.

Coinbase net revenue (Created by author Deep Tech Insights)

Of course, lower crypto prices doesn’t need to mean less trading volume, but usually this has been the case for Coinbase and many crypto exchanges. Given the exchanges make their primary revenue from trading volume fees, the revenue hit is substantial. With total transaction revenue for the fourth quarter of 2022 declining by 12% sequentially to $322 million.

Investors seem to have felt the squeeze from the macroeconomic environment (high inflation and rising interest rates) and thus I believe there was a surge in panic selling initially. A negative for crypto is this does indicate the asset is not an “inflation hedge”, as many people first assumed (but I will not be getting into that debate in this post). Many crypto investors have also decided to just “hold” or “hodl” (if you were a former meme stock trader) their crypto assets.

Rising Interest Rate Benefits

A positive for Coinbase is the company can still generate revenue from assets held on its platform through a combination of staking and also interest income. In this case, the company reported a solid 79% sequential increase in interest income to $182 million in the fourth quarter of 2022. This was mainly driven by the rising interest rate environment, which enabled a net benefit on its $5 billion in customer fiat balances, despite the overall amount declining from $6.6 billion in the third quarter of 2022.

Coinbase also offers a variety of programs related to the USDC (USDC-USD), which is a stablecoin pegged to the U.S. dollar. In the fourth quarter, the company reported $2 billion in USDC on its platform, with $1.1 billion from retail consumers and ~$861 million from institutional or corporate customers. This offers its customers up to 1.5% annual percentage yield on balances held on the platform and Coinbase continued to scale its USDC rewards program internationally.

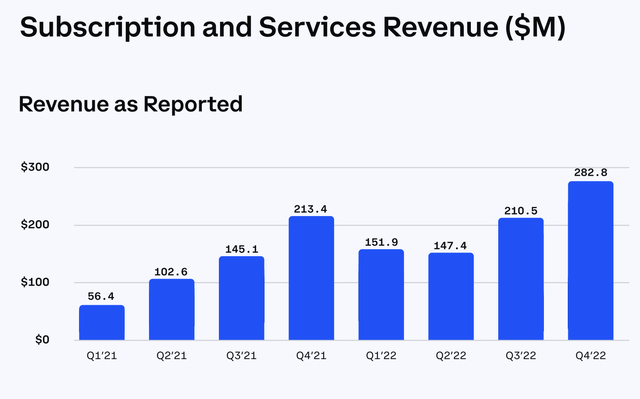

Another positive for Coinbase is the company has continued to grow its subscription and services revenue by a solid 34% sequentially and 32.5% year over year. This was driven by growth in the Coinbase One program, as well as the aforementioned staking, with a particular benefit from the expansion of Ethereum 2 (ETH2) staking across Canada and Australia.

Subscription and Services Revenue (Q4 22 report)

Trading Volume Breakdown

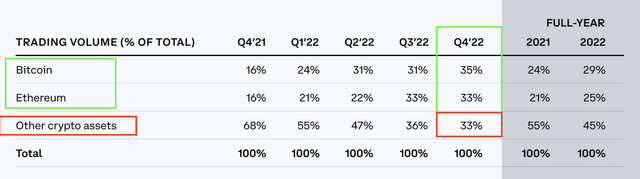

On the table below, we can see a breakdown of trading volume by crypto type. It was interesting to see “Other Crypto Assets” have declined as a portion of total trading volume from 68% in Q4 ’21 to just 33% to Q4 ’22. I believe this makes a lot of sense and was likely a result of a decline in the number of speculative coins and new ICOs or initial coin offerings. In fact, data from Statista indicates the number of cryptocurrencies globally peaked at 10,397 in February 2022 and has now declined to 8,695 by February 2023. A positive is there has been a “flight to safety” toward the most well-known crypto assets Bitcoin and Ethereum, which made up 35% and 33% of crypto trading volume respectively.

Trading Volume Crypto (Q4 ’22)

Since late December to late February 2023, the price of Bitcoin has actually increased by over 45% and Ethereum by over 37%. Thus, this could be an indication the crypto market hit a “bottom” in November and December 2022, after the collapse of FTX and the negative news cycle surrounding its founder Sam Bankman Fried. Shark Tank investor Kevin O’Leary (who was also an FTX spokesperson who lost ~$10 million on the collapse) stated at the time that the situation may actually be a “positive for crypto”, in an interview with CNBC. This is not so crazy as often it takes a disaster to increase industry regulations and consolidate a fragmented market. Given Coinbase is the leading U.S. crypto exchange, this could actually be a positive as it means less competition is likely to arise.

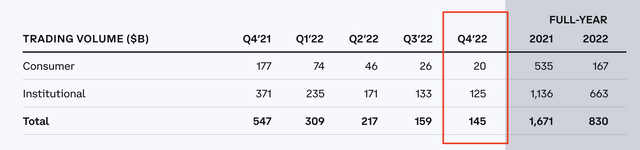

Breaking down trading volume by customer type, Consumer (or retail trading) volume plummeted from $177 billion or 32% of the total volume in Q4 ’21 to just $20 billion or just 13.79% of the total by Q4 ’22. While Institutional Trading volume declined on a net basis, from $371 billion (Q4 ’21) to $125 billion by Q4 ’22. However, institutional trading actually increased as a percentage of revenue from 67.8% in Q4 ’21 to ~87% by Q4 ’22.

I believe this dynamic may actually be positive for Coinbase, as it shows the asset class is being taken more seriously by institutional funds (even despite the decline) and these investors look to be slightly less shaken by the volatility. It is also a testament to the technology and trust embedded inside the Coinbase platform as a U.S. based entity.

In the third quarter of 2022, Coinbase was even selected by the world’s largest asset manager BlackRock to provide crypto trading access to clients of its Aladdin (end-to-end investment platform). BlackRock has also previously added Bitcoin futures and derivatives to two of its investment funds. In January 2023, reports indicated BlackRock has added Bitcoin as an eligible investment into its Global Allocation Fund. In an interview at a New York Times event, following the implosion of FTX (of which BlackRock was also an investor), CEO Larry Fink stated that he believed “most crypto companies won’t be around”, but the collapse of FTX is “not the end of De-Fi”. I tend to agree with this, as I believe we are currently seeing a consolidation of a previously fragmented industry and Coinbase is poised to cement its position. In the fourth quarter earnings call, management stated they had seen an “elevated” number of institutional investors onboarding onto its Coinbase Prime program.

Consumer Institutional Investors (Q4 ’22 report)

Margins and Expenses

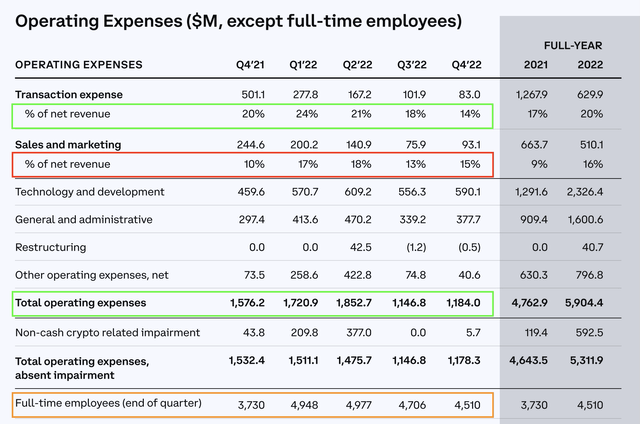

Coinbase has managed its expenses well in the fourth quarter of 2022. Total operating expenses were $1.184 billion which declined by 24.8% year over year, from the $1.576 billion reported in Q4 ’21. This was primarily driven by lower transaction expenses (as less trading volume). However, as a percentage of revenue, this also declined from 20% in Q4 ’21 to 14% by Q4 ’22, which could be an indication of operating leverage improvements; thus, this is a positive for long-term profitability.

Coinbase has also increased its investments in technology and development which have increased by 20.28% year over year to $590.1 million. This shows the company is still investing into the future and improving its technology and products, no matter what is happening in the crypto market. Some people may say this is risky and that the company should be cutting costs in all areas. However, many studies indicate those companies which tend to invest a large percentage of revenue into R&D tend to generate more shareholder value long-term. For example, Meta Platforms (META) has actually accelerated its R&D spend in the recent years, despite volatility with its core business.

Management did admit that they “hired too quickly” during 2022 and reported a 24% increase in employee count to 4,510 by Q4 ’21. A positive is management has begun to act fast and announced another round of layoffs on January 10th 2023, which would remove 950 employees from the company. Of course, this is not great for the employees (and team morale) and I feel bad for them. However, CEO Brian Armstrong believes this could help reduce operating expenses by 25% which is substantial.

Operating Expenses (Q4 ’22 report)

In Q4 ’22, Coinbase reported an earnings per share [EPS] loss of $2.46, which was substantially worse than the $4 per share profit in Q4 ’21. A positive is its Q4 ’22 result did surpass analyst expectations which were expecting negative $2.55 per share, according to Refinitiv data.

Its full-year net loss was a staggering $2.6 billion which included a substantial $694 million impairment in its ventures portfolio.

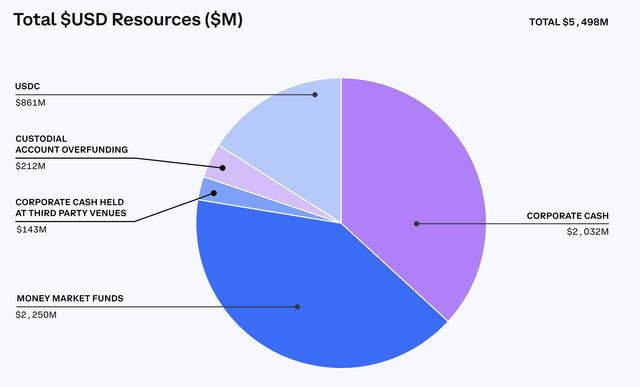

Coinbase reported a solid balance sheet with $5.5 billion in cash and cash equivalents. In addition, the company reported $3.393 billion in long-term debt.

Valuation and Forecasts

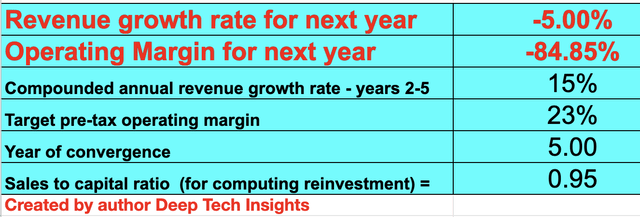

Valuing Coinbase is extremely challenging given its future cash flows are widely dependent upon the future of cryptocurrency and the popularity of crypto trading. In this case, I have plugged its latest financial data into my discounted cash flow valuation model. In this case, I have forecast negative 5% revenue growth for the full year of 2023. I forecast this to be driven by the continued stagnation in crypto trading. However, I forecast this to be offset slightly by price momentum (given the recent increase in crypto prices), improved regulation, and continued growth in Coinbase’s subscription revenue.

In the Q4 earnings call, management didn’t give overall revenue guidance but they did forecast continued growth in Subscription and Services revenue to between $300 million and $325 million in Q1 ’23, as per the current trend. In years 2 to 5, I have forecast 15% revenue growth per year. This is fairly optimistic but driven by a favorable comparison to the poor 2022, as well as the aforementioned growth in interest income and subscription income. Crypto prices may also bounce back post-recession as “risk capital” flows back into more speculative assets, although this is unknown.

Coinbase stock valuation 1 (Created by author Deep Tech Insights)

To increase the accuracy of the model, I have capitalized the company’s R&D expenses. In addition, I have forecast a pre-tax operating margin of 23% over the next 5 years. This is based upon improved business efficiency following the cost-cutting, as well as increased operating leverage for the business as a whole.

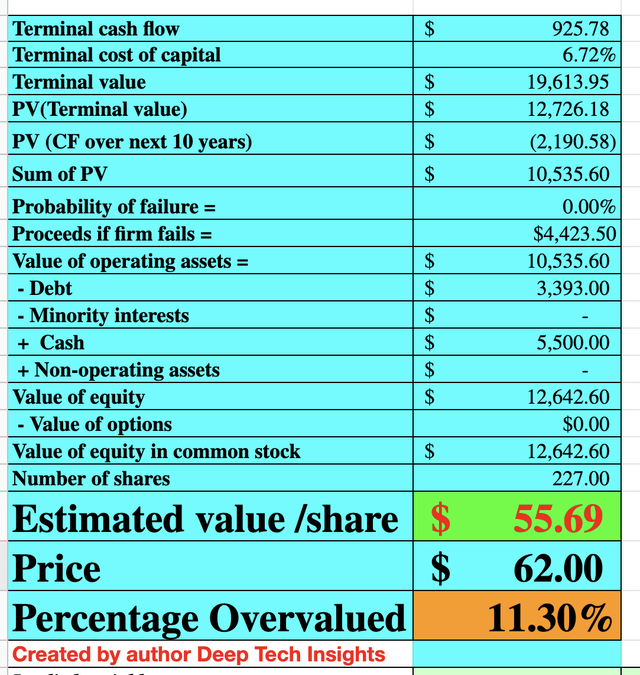

Coinbase stock valuation 2 (Created by author Deep Tech Insights)

Given these factors, I get a fair value of ~$55.69 per share, the stock is trading at ~$62 per share at the time of writing and thus is ~11.3% overvalued, according to my forecasts and model.

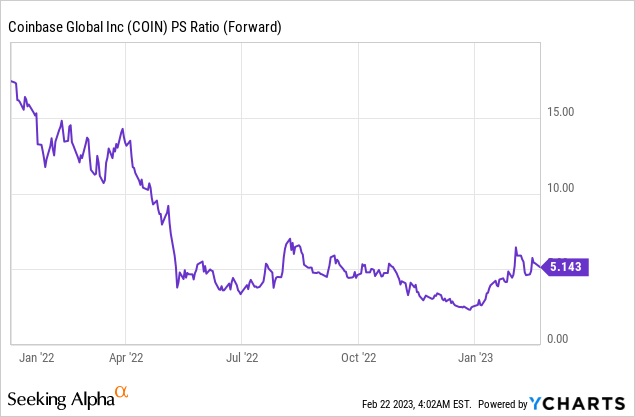

A positive is the company trades at a forward price-to-sales ratio = 5.1, which is significantly cheaper than its P/S ratio in 2022 of over 17.

Risks

Crypto May Not Bounce back/Recession

The harsh reality is there is no guarantee crypto prices will bounce back, thus this is a risk for investors in COIN stock. A positive is the historic trend shows after previous crashes, crypto prices have bounced back. In addition, the infrastructure, partnerships, and crypto “brand” power is much stronger than during the 2017 bear market, even with the collapse of FTX.

Final Thoughts

Coinbase has continued to produce better-than-expected financial results, despite the ongoing “crypto winter”. A positive is major bear markets often filter out the worst companies and leave the best still standing, think of Amazon rising after the dotcom bubble/crash of the year 2000. While many other e-commerce retailers (Pets.com etc.) went bankrupt. I believe we are seeing a similar situation in the crypto market, and the industry is consolidating which is a positive for Coinbase. However, I believe throughout 2023 we will likely see continued volatility across the crypto sphere, especially given the macroeconomic environment and forecasted recession. Given my valuation model and forecasts indicate Coinbase is slightly overvalued, I will label the stock as a “hold” for now.