Leon Neal/Getty Images News

Thesis

I believe Coinbase (COIN) can be a viable investment over time through platform user growth and service expansion while breaking the highly correlated price action it currently has to major cryptocurrencies. I believe user growth will continue strongly moving forward, barring price depressions in the aggregate crypto market, because of its simplicity and service offerings. By attracting new users with minimal direct advertising costs, I believe Coinbase will be able to increase revenue per user through a growing services portfolio offered to customers. Coinbase operates not only as the largest U.S.-based crypto exchange but also as an asset custodian and broker to its client base which I believe is key for future growth in revenues outside of trading fees.

Company & Industry Background

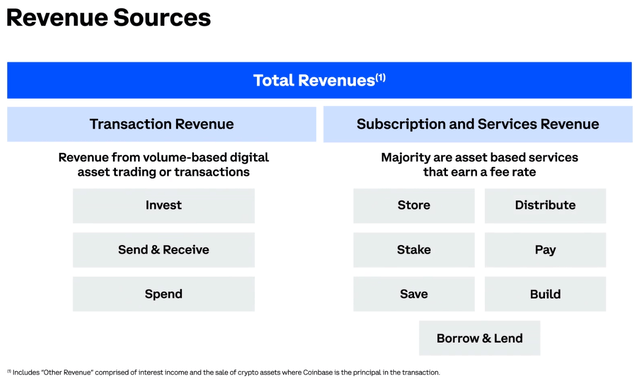

Coinbase is an on-ramp for retail and institutional customers around the world to access the crypto economy. On Coinbase’s platform, customers can buy and sell an array of different cryptocurrencies where Coinbase earns a transaction fee during the process. Coinbase also acts as the asset custodian where it currently holds $255 billion in assets.

Coinbase acts as an asset custodian, broker, and service provider to its clients in an all-inclusive package. Services Coinbase offers includes:

- Coinbase Prime: Advanced trading and analytics for institutional clients.

- Coinbase Cloud: Intended to enable developers to build and integrate products more efficiently.

- Coinbase Wallet: Self-hosted software wallet that allows access to DeFi apps, NFT marketplaces, and sending and receiving crypto functionality.

- Enhanced Security Features: Physical security key for 2-factor authentication.

I believe the entire crypto-economy is very volatile and trading fees are highly correlated with the price action of very popular cryptocurrencies like Bitcoin and Ethereum. By offering services on top of an accessible trading platform, I believe Coinbase will be able to reduce stock price correlation to volatile crypto assets.

During their last earnings announcement, Coinbase plans to launch the following new services:

- Coinbase NFT: Allows users the ability to mint, collect, discover, and showcase NFTs.

- Payroll and Expense Reimbursement Allows users the ability to be paid directly in crypto, spend on their Coinbase Card, earn rewards, and more.

- Retail Advanced Trading: Taking popular features from Coinbase Prime (staking and earn) to the retail traders.

Thesis Support

User Growth

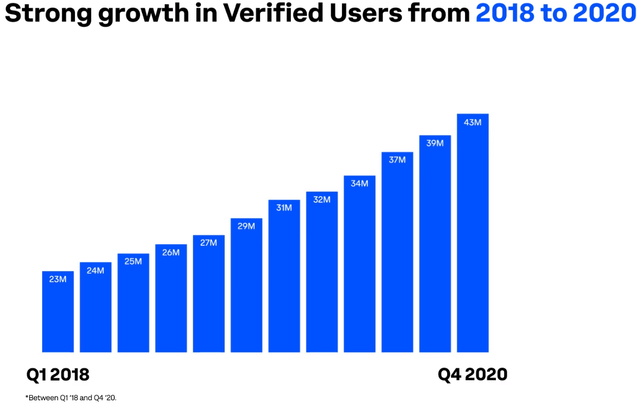

While user growth has spiked since the price of major cryptocurrencies has taken off in the past few years, I believe long-term secular user growth will continue because of regulation and global scale. Because Coinbase is widely regarded as having a secure and the most simple to use platform, user migration to their services will expand naturally with broad industry growth, in my opinion.

With over 90% of Coinbase retail users coming to the platform organically or through word-of-mouth advertising, I also believe future user growth will come with minimal direct advertising costs, potentially allowing for margin expansion.

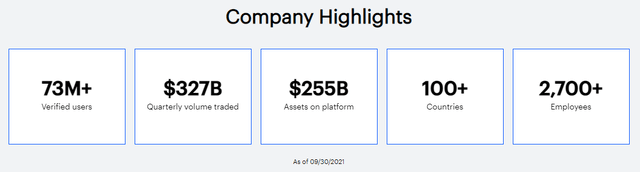

Currently, Coinbase is the largest U.S.-based crypto exchange with 73 million verified users as of Q3 ’21, a 47% CAGR since 2018.

Service Revenue

Service revenue expansion I believe is the greatest long-term catalyst for Coinbase. Operating as the exchange, broker, and asset custodian for customers on the platform, Coinbase has the opportunity to control the entire process of buying, selling, storing, and using cryptocurrencies on its platform. While the processes are controlled by many different companies in other public markets, Coinbase’s ability to monopolize gathering, storing, and transacting crypto provides them a long-term, high growth potential runway in my opinion.

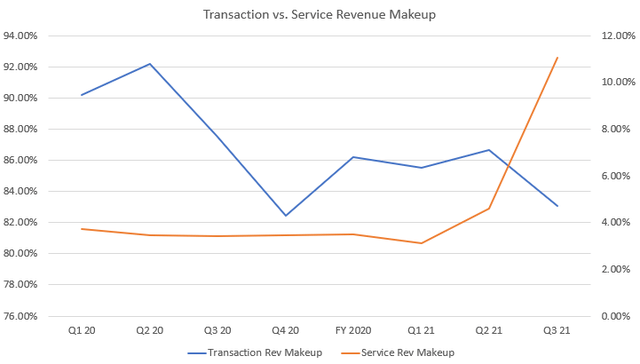

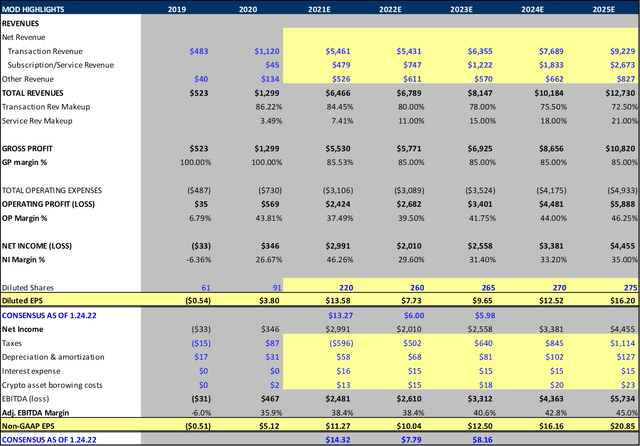

In Q1 ’20, transaction revenues made up over 90% of Coinbase’s total revenues while services made up less than 4%. In the most previously fiscal quarter, transaction revenues made up 83.06% of total revenues while services have climbed to over 11% makeup.

(Note: segments represented don’t add to 100% because total revenue also accounts for the ‘other revenue’ segment. Other revenue includes the sale of crypto assets and interest income. ‘Service Rev Makeup’s y-axis is on the right side of the chart.)

After listening to management explain their future trajectory I believe Coinbase is still in the early innings of constructing a service portfolio for clients to use.

By continuing to add and refine their service portfolio, I believe Coinbase will increase service revenue’s total makeup drastically compared to transaction revenue. I believe this will not only generate higher margins and increased earnings because of the service scalability potential, but I also believe an increase in service revenue makeup will greatly reduce the stock price correlation to major cryptocurrency assets, hedging out crypto asset volatility.

Financials

Before disclosing my forecasts for Coinbase, I want to mention that I believe forecasts for this company’s future earnings profile are extremely difficult to calculate. In my opinion, my forecasts provide a general sense of where the company may be over the next five years but accurately predicting earnings and margins out are increasingly difficult because of crypto asset volatility, competition, and a short operating history to base models on.

If growth can stabilize on the top-line and Coinbase can keep net income margins above 30% moving forward, I believe current valuation levels look extremely attractive.

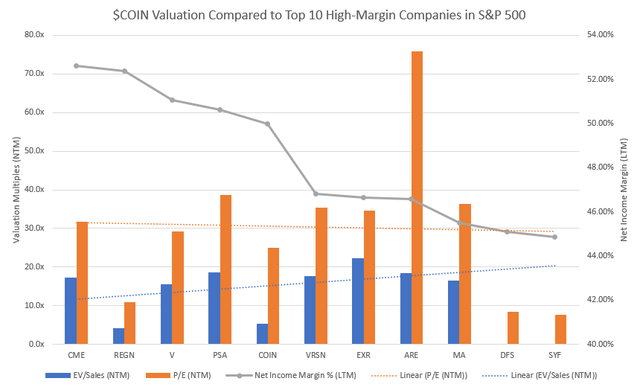

While Coinbase had an extraordinarily high net income margin in the last twelve months due to tax benefits incurred in Q2 and Q3 ’21, I wanted to compare their current valuation levels to some of the highest margin companies in the S&P 500 (excluding those with one-time benefits).

While I believe Coinbase’s net income margin will normalize to the low 30s% in the next few years, I believe potential top-line and service segment growth will drive margins higher over the long term. When comparing Coinbase to high-margin businesses in the S&P 500, they trade at discounts to comp trendlines in both NTM EV/S and P/E multiples.

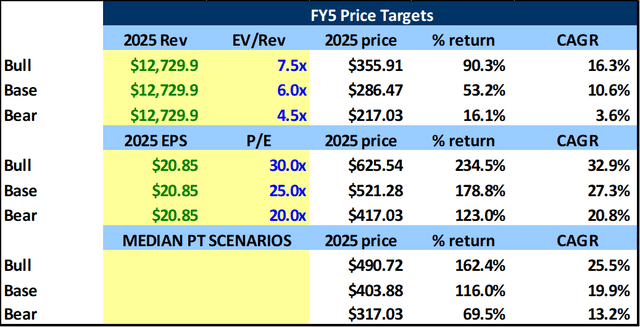

Using my earnings and multiple forecasts for Coinbase, I’ve created price targets for FY ’25:

(EPS-based PTs are calculated by multiplying EPS of $20.85 by the P/E multiples of 30x, 25x, and 20x. Revenue-based PTs are calculated by multiplying revenue of $12.730 billion by the EV/S multiples of 7.5x, 6x, and 4.5x subtracting net debt of -$2400 million and dividing that by diluted shares outstanding of 275 million. % Return and CAGR columns use a present value share price of $187. CAGR is using an n=4.25 years.)

Risks

Short-Term

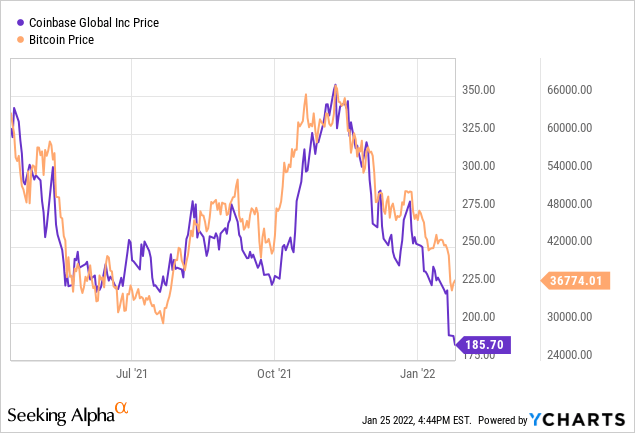

I believe the biggest short-term risk to Coinbase is the high correlation the stock price has to Bitcoin and other major cryptocurrencies.

The extremely high correlation has caused excess volatility in Coinbase’s stock in my opinion. I do believe this risk will be mitigated in the future as transaction revenues become a less significant portion of total revenues but will continue to drive short-term price fluctuations in the foreseeable future.

Long-Term

While much of the current U.S. brokerage-based competition is tied to Robinhood (HOOD), if major brokerage firms like Charles Schwab (SCHW) and Fidelity offer a crypto platform similar to Coinbase, the competitive landscape would increase drastically and very quickly. I believe Coinbase would still dominate market share moving forward but growth rates would slow and margins would potentially contract.

Summary

While I believe the competitive landscape could become worse for Coinbase in the future, I still believe the company has an excellent growth runway that will drive earnings. While the stock is still highly correlated to volatile crypto assets, increased service revenues will break the correlation, drive earnings power, and provide more stability in stock price, in my opinion. At an NTM P/E of less than 25x, I believe Coinbase also currently presents an attractive entry after being cut in half following the IPO in April of last year.