- The popularity of XRP has increased, but price action is still erratic in the face of an SEC investigation and continuing regulatory uncertainty.

- Good long-term prospects for XRP, supported by SBI VC Trade, with possible wide adoption by Japanese banks by 2025.

As XRP, the cryptocurrency of Ripple, keeps grabbing the interest of the cryptocurrency world, its recent rise in social metrics suggests a surge in popularity. But the timing of this increased attention is concerning investors given the price behavior of XRP.

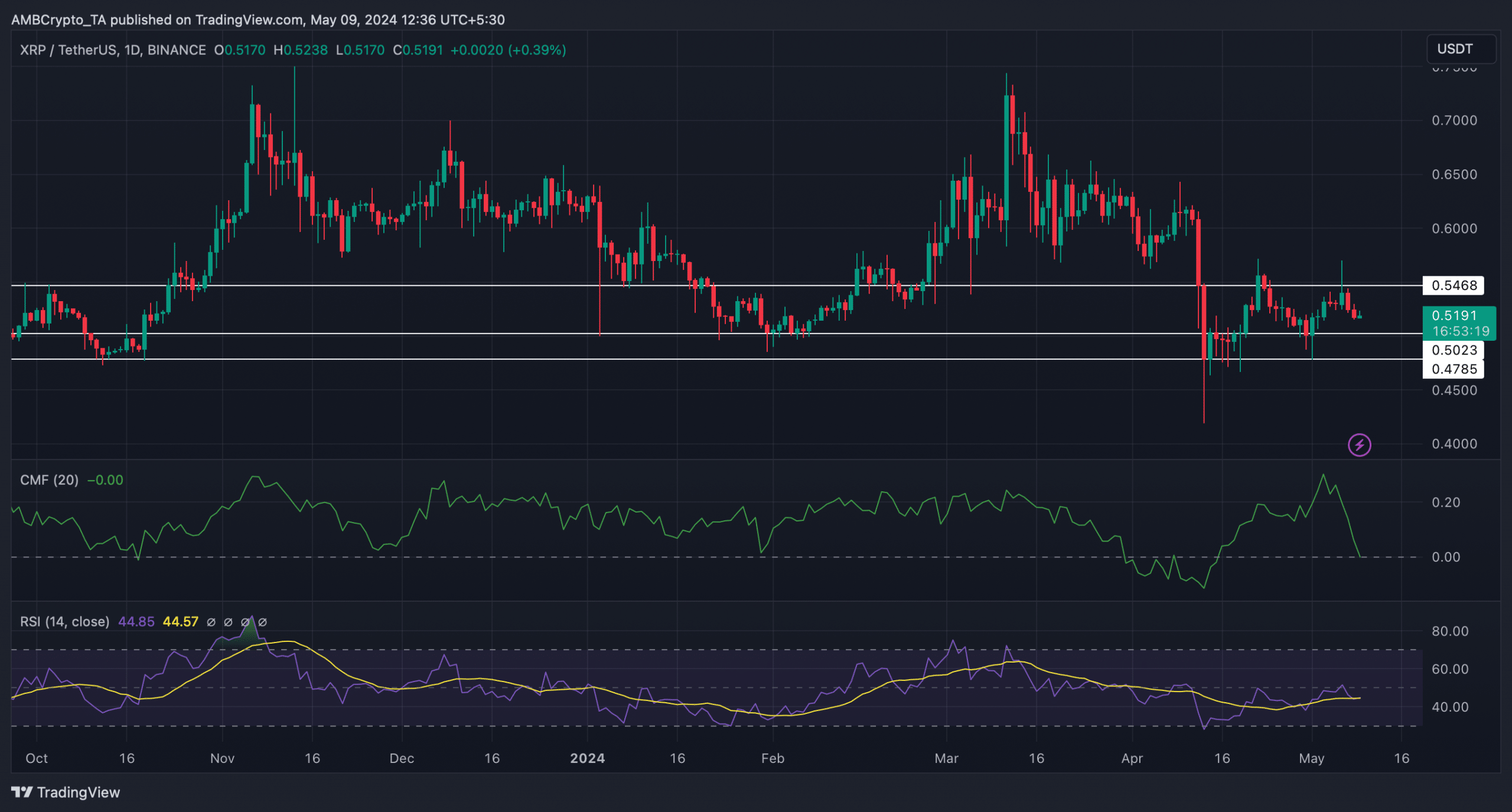

CoinMarketCap data show that the price of XRP at the moment of writing is about $0.5167, down 1.45% over the previous week and 0.30% over the previous 24 hours.

SEC’s Close Observation: The Effect on XRP Price

Particularly with its most recent announcement classifying Ripple Lab’s proposed stablecoin as a “unregistered crypto asset,” the US Securities and Exchange Commission (SEC) has added to the intense debates surrounding XRP. Even if XRP is the seventh-largest cryptocurrency by market capitalization—more than $28.7 billion—this regulatory scrutiny may be affecting the market’s cautious attitude toward the cryptocurrency.

Even if the price of XRP has slightly dropped, investor attitudes are much different. With XRP’s exchange outflow continuing high and its supply on exchanges falling, there is a clear accumulation tendency that suggests strong buying demand even in the face of price declines.

Technical signs, though, advise prudence. A classic bearish indication, the price of XRP recently dropped below its 21-day moving average.

Technical indicators, such as the Chaikin Money Flow (CMF) and the Relative Strength Index (RSI), also exhibit notable downward trends, suggesting that the price of XRP may drop further in the near future, maybe reaching a support level close to $0.50 and then falling even further to $0.47.

In the middle of these obstacles, XRP’s network growth has decreased throughout the past 30 days, suggesting fewer new addresses being generated for transactions. This can be a sign of the market’s caution, brought on by continuous regulatory uncertainty.

Japanese Banks and Investor Confidence

More upbeatly, well-known XRP enthusiast JacktheRippler on platform X recently brought attention to the CEO of SBI’s hopeful prediction that, by 2025, every bank in Japan may use XRP once SBI VC Trade becomes a new XRP validator, in line with what CNF previously disclosed. This development suggests possible long-term expansion in Japan fueled by institutional acceptance.

BOOOOOOOOOOOOOOOOOOM!!!

SBI Japan has started to run their #XRP-Ledger Validator!

SBI CEO: “Every Bank in Japan will use XRP by 2025.” pic.twitter.com/w4dR2FSr8N

— JackTheRippler ©️ (@RippleXrpie) May 10, 2024