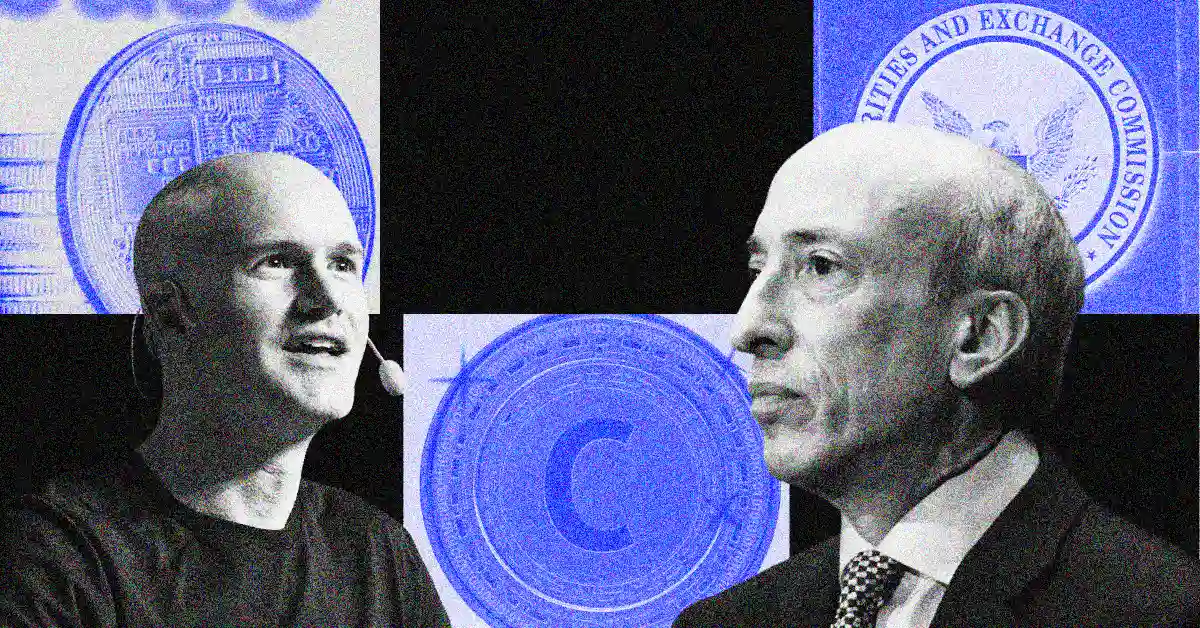

Crypto exchange Coinbase filed a response to the SEC’s comments on its interlocutory appeal request. Coinbase is asking the SEC to clarify whether digital asset transactions without obligations on the original issuer, qualify as investment contracts under SEC regulations.

Coinbase Filed a Savvy Response

On May 24, Coinbase filed a memorandum supporting its appeal against a specific ruling in an ongoing case with the SEC. This document responds to the SEC’s opposition to Coinbase’s initial appeal request.

Coinbase initially filed the appeal on April 12, contesting a March 27 ruling that the SEC had sufficient grounds to claim that Coinbase’s staking program was an unregistered securities offering.

Coinbase’s main argument in the appeal is that the core issue is whether an investment contract requires a contractual undertaking. Coinbase argues that, according to SEC regulations, digital asset transactions without post-sale obligations to the original issuer should not be considered investment contracts.

The SEC, opposing Coinbase’s appeal contends that no court has required a post-sale contractual undertaking for the application of the Howey test, which determines what constitutes a security.

SEC’s Take!!!

The SEC, opposing Coinbase’s appeal contends that no court has required a post-sale contractual undertaking for the application of the Howey test, which determines what constitutes a security.

Furthermore, the SEC has argued that Coinbase’s request lacks legal merit. The commission contends that the court has already dismissed Coinbase’s arguments and that the latest appeal request also fails to establish sufficient legal grounds. The SEC maintains that there is no doubt the appeal should be halted.

Potential Industry Impact

The outcome could affect other SEC actions in the cryptocurrency industry. As the courts, including Judge Katherine Polk Failla, will decide if the appeal can proceed.

However, she had previously denied Coinbase’s request to dismiss the SEC’s original case. Meanwhile, the resolution of this case could set a precedent that shapes the future of digital asset regulation.