16h30 ▪

4

min of reading ▪ by

The Fed claims that Americans are shunning cryptos, questioning Coinbase’s figures. In January, the crypto exchange asserted that 52 million Americans owned crypto assets. Who to believe, the Fed’s reserve or Coinbase’s unbridled enthusiasm?

Cryptocurrencies: A Fleeting Affair for Americans?

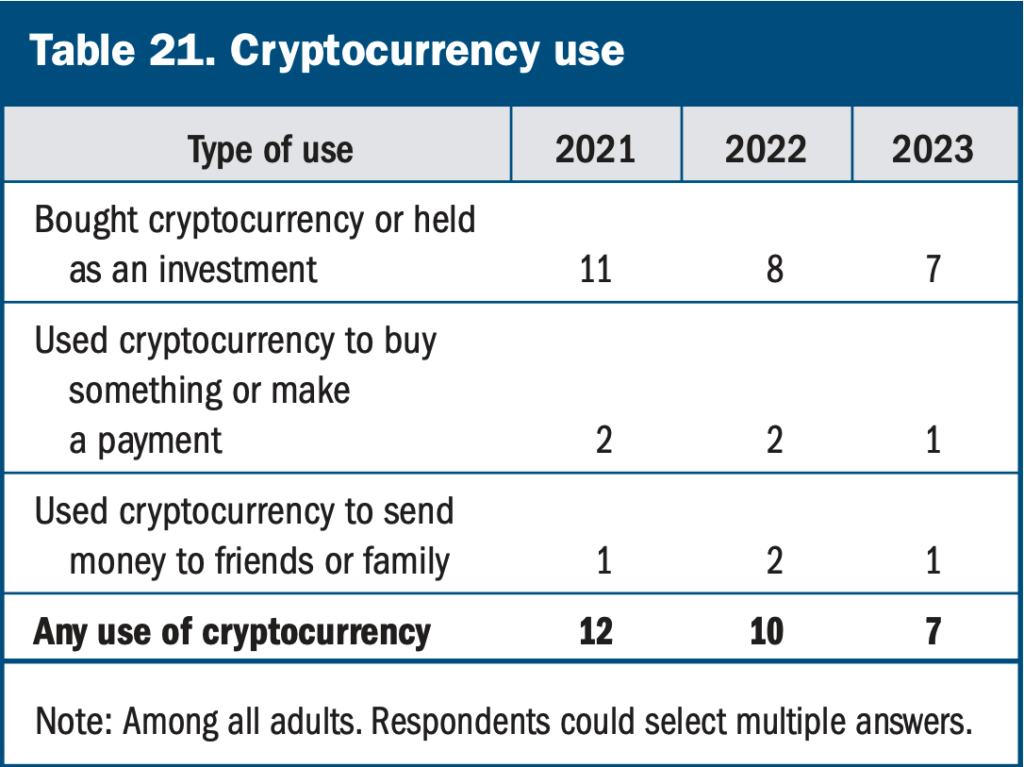

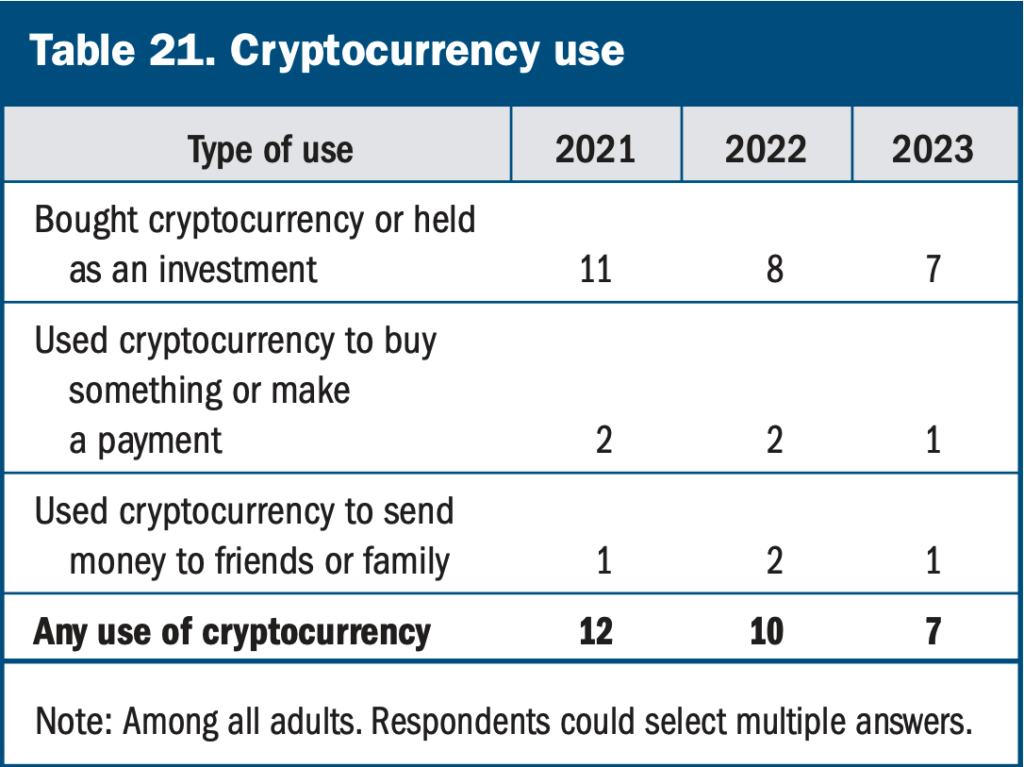

Is crypto-mania losing steam across the Atlantic fearing a repeat of the FTX scenario? That is at least what the latest Fed survey on the economy and household decision-making suggests, published on May 21. A scathing survey reveals that only 7% of American adults used cryptocurrencies in the 12 months preceding October of last year. A plummeting figure compared to 12% in 2021 and 10% in 2022.

In this changing landscape, crypto adventurers are rare: only 1% of adults still dare to use cryptos for payments or money transfers. A percentage halved compared to the previous year. Among these daring individuals, nearly 30% do so because their counterpart prefers this method, while lack of trust in banks is the least cited reason.

The wealthy, however, seem to appreciate this digital currency: those earning more than $100,000 per year are the most likely to invest in Bitcoin (BTC) and the like. The millennials (30-44 years) lead the pack, closely followed by Generation Z (18-29 years). Notably, men are three times more likely to dive into the crypto world than women.

Ethnic disparities are also marked: Black and Hispanic adults favor financial transactions in crypto, while Asians prefer cryptocurrencies as investments. White adults, on the other hand, seem the least interested in this new digital economy.

This survey, conducted in October 2023 among 11,488 adults, and weighted to represent the 258 million American adults, paints a nuanced picture of the enthusiasm for cryptocurrencies.

The Fed’s and Coinbase’s Figures: A Crypto Gap

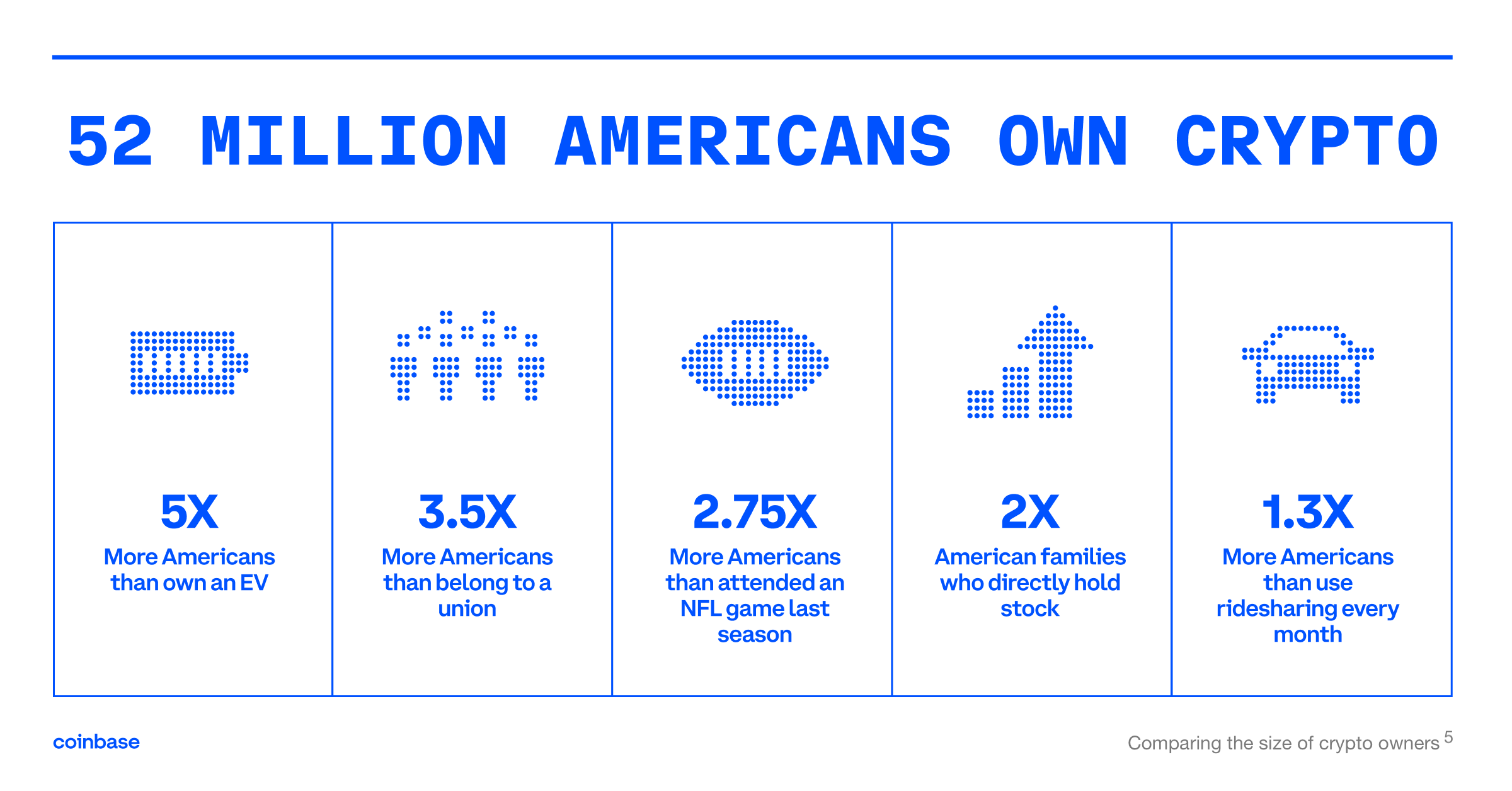

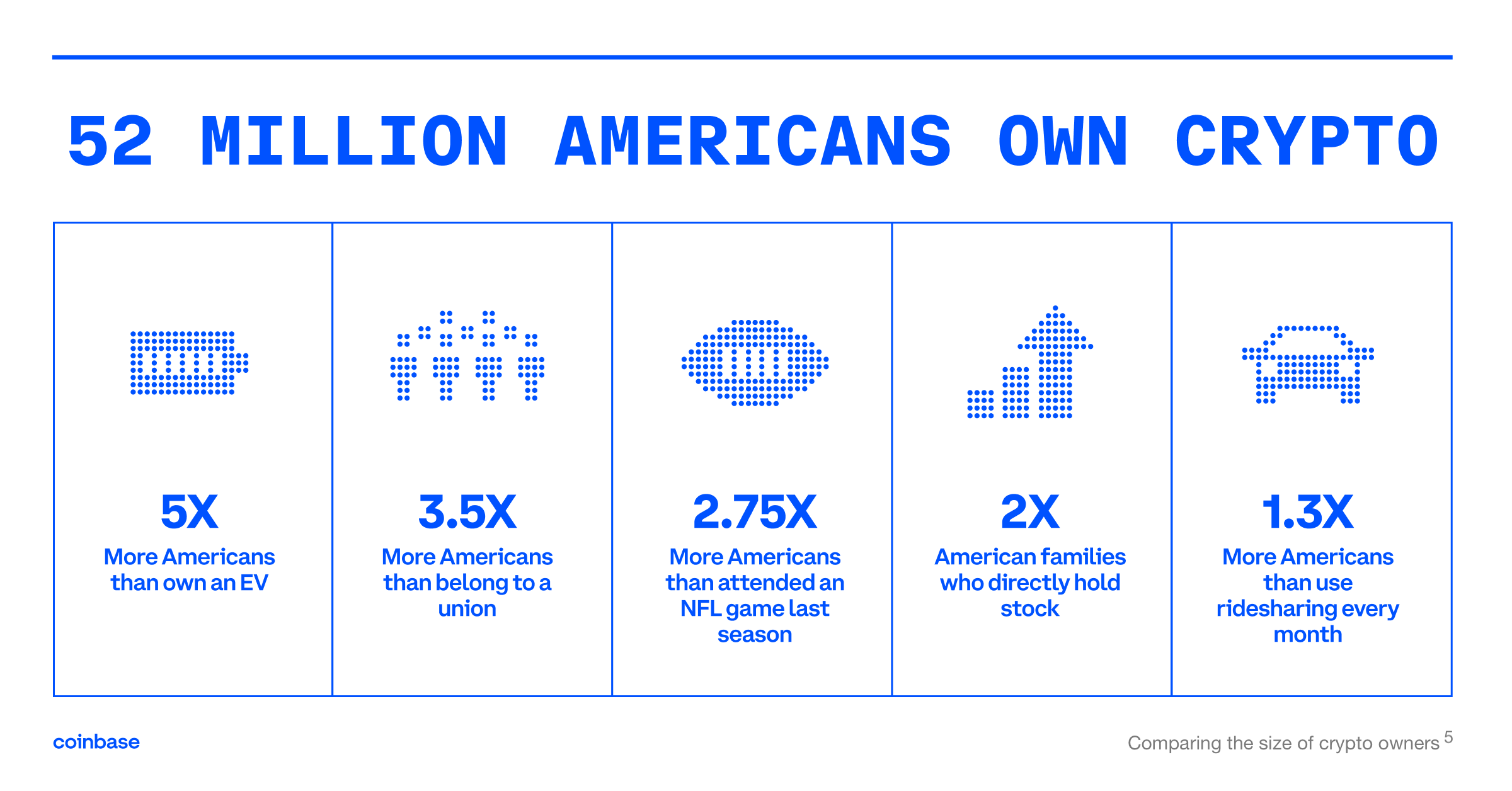

The Fed’s figures are far from resembling those of Coinbase in its 2023 cryptocurrency study. Indeed, Coinbase painted a much rosier picture: nearly one in five Americans would own crypto, or 52 million people.

Coinbase, in its exuberant enthusiasm, claims that 87% of Americans want a reform of the financial system, finding it unfair and biased in favor of the powerful. In echo, 63% of cryptocurrency owners believe that blockchain technology can democratize the economy.

But the Fed, on its side, highlights that only 1% use cryptocurrencies for transactions, primarily because their recipients prefer them.

According to Coinbase, the younger generations are the most fervent crypto enthusiasts: 72% of 18-34 year-olds believe that digital assets represent the future of finance.

Coinbase advocates for clear legislation to govern crypto, emphasizing that 87% of Fortune 500 leaders consider clear rules essential to maintaining American leadership. Conversely, the Fed remains discreet on the subject, merely noting a decrease in crypto usage.

Thus, the two studies offer contrasting views of the crypto universe: optimistic and reformist at Coinbase, cautious and realistic at the Fed.

It remains to be seen which of the two will eventually convince lawmakers, currently very focused on the FET21 Act, and citizens.

Maximize your Cointribune experience with our ‘Read to Earn’ program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Click here to join ‘Read to Earn’ and turn your passion for crypto into rewards!

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.