Although the cryptocurrency landscape can often seem mysterious to newcomers, factors like market capitalization can provide a key insight into the performance of assets and how they differ from other coins within the ecosystem.

Market capitalization, or market cap for short, indicates the dominance and popularity of cryptocurrencies and can help investors understand why some coins, like Bitcoin, can rise in value while others remain static.

Differences in cryptocurrency values can be tracked more efficiently through market capitalization, and investors can gain invaluable insights into one of the driving forces in crypto.

But what is market capitalization?

What Is Market Capitalization?

Market capitalization is a metric rooted in more traditional finance, and it can refer to the total dollar value of all the shares of a company’s stock. When exploring this metric in a crypto landscape, market capitalization equates to the total value of all the coins that have been minted.

So, how can an investor work out the capitalization of a cryptocurrency? To find the market cap of a coin, investors can use the following formula: Market Cap = Current Price x Circulating Supply.

In a nutshell, this formula focuses on multiplying the total number of coins minted or produced by the price of a single coin. Because the price of a single coin can vary significantly at different stages in the market, their respective market caps can change drastically, too.

The image below shows that the total cryptocurrency market capitalization stands at around $1.2 trillion at the time of writing, the total value of all coins in the crypto industry.

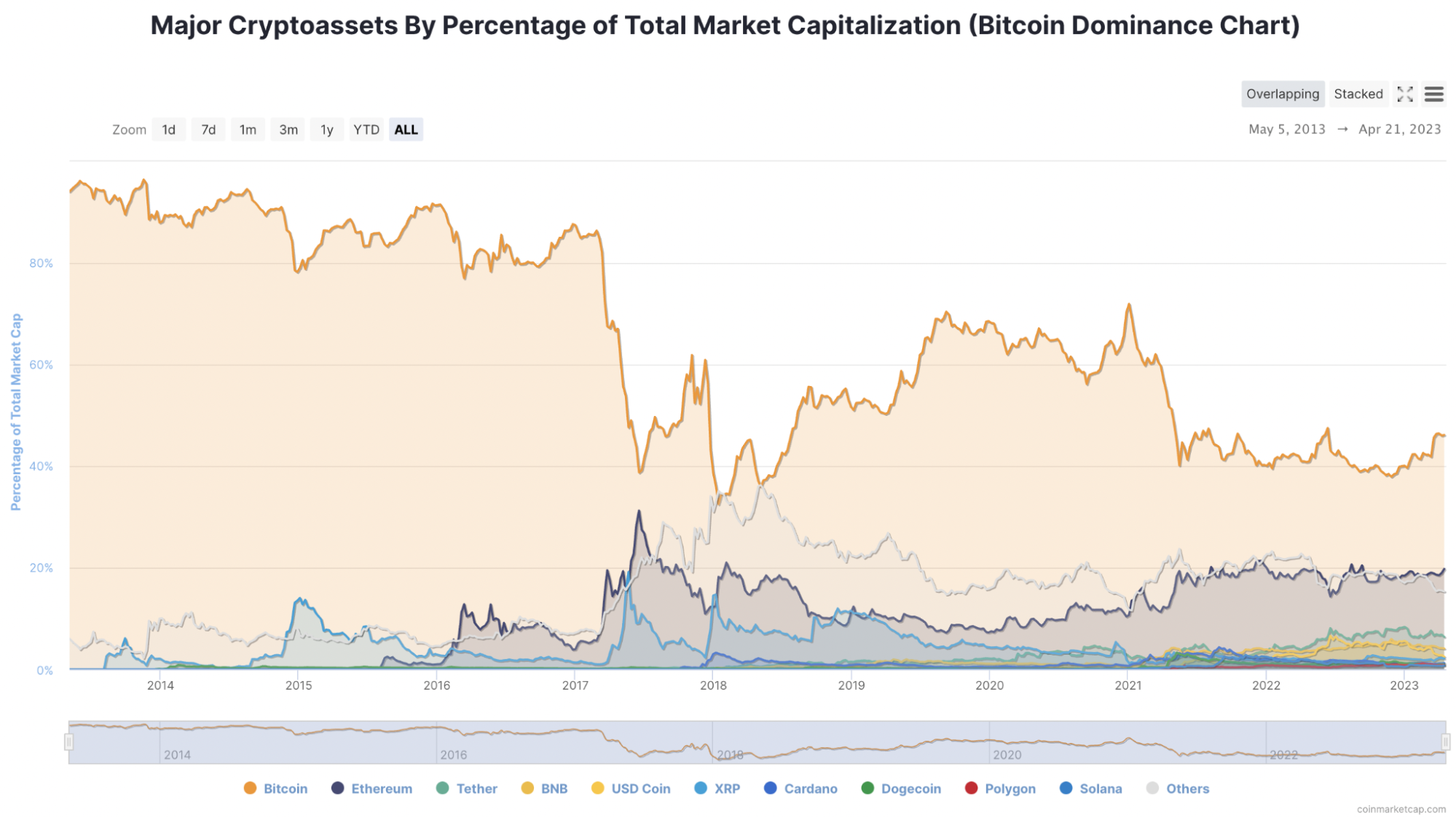

Analytical websites like CoinMarketCap charts the market share of different major assets by market capitalization.

Often referred to as a Bitcoin dominance chart due to the sheer scale of BTC’s popularity among investors, we can see that varying market caps can indicate the size of an asset even if their respective prices are far more varied.

Market capitalization can be a great tool when it comes to determining the stability of an asset. Although nothing is certain in the crypto world, larger cap assets are generally better anchored in the face of market volatility, helping to sidestep large-scale panic selling or jittery holders. However, this doesn’t protect crypto investors against market volatility and unstable prices.

Does Market Capitalization Affect Crypto Trading?

As well as an indicator of stability, the market cap of an asset can give investors an idea of a project’s strength and how well it’s performing in general. This can help investors make more informed decisions when thinking about investing in a particular cryptocurrency.

By empowering investors to study the total value of one cryptocurrency compared to another, market cap is a strong tool that can help deliver more informed investment decisions.

Furthermore, it can aid investors in discovering the safest assets to buy compared to others, as well as the past performance and growth potential of any given coin.

Through these trends, traders can look at how emerging cryptocurrencies are growing in new technological spaces.

For instance, if a decentralized finance project performs well, investors can see beyond its daily price movements and explore how its market cap is growing. In addition, combining the caps of different sectors within crypto can also provide insights into whether a market segment is attracting or losing investors.

Protecting Against Market Volatility

Because crypto can be more convoluted and volatile than traditional finance due to emerging technologies and fast-moving markets, using data to gain an advantage is paramount.

Although it’s dangerous to impose any rule-of-thumb approaches to crypto, investors can identify small market cap altcoins worth less than $5 billion in capitalizations as prone to more volatility and erratic price movements.

The reason for this is simple. If there aren’t as many coins held by investors, a major transaction or decision for an investor to liquidate their holdings will cause a significant drop in capitalization for the asset. Likewise, if a whale chose to buy into a small-cap asset, it would likely make a major wave in pumping the asset’s market cap.

Naturally, this doesn’t mean traders should avoid small-cap currencies. Still, it’s more a case that the lower the market capitalization, the more likely that the asset will undergo wild price fluctuations. Depending on how risk-averse an investor may be, a small-cap coin may be a blessing or a curse.

Never Rely on Market Cap Alone

Although coin market capitalization can be a major asset in gaining a holistic view of a cryptocurrency, it shouldn’t be relied upon as a sole purchase or sell indicator.

There are many reasons why a coin’s market capitalization is a certain value. Without further research, it’s very difficult for investors to understand why a certain price has prevailed for an asset.

While it’s possible to see the stability of tokens, market capitalization can miss out on more volatile mid-cap currencies with plenty of untapped growth potential.

For this reason, market capitalization can never replace good old-fashioned market research, and in an environment as unpredictable as crypto, more insight available to investors always comes in handy. Unlike with companies, where market capitalization is based on the stock price, which is based on a few factors like revenue, size of the company and its potential, crypto market capitalization is based on circulation and price.

Factors such as 24-hour trading volume and sentiment analysis are great tools to use in conjunction with market capitalization. If you can generate a more holistic view of your assets, you’re more likely to find yourself in a position of power in trading.

Building a Comprehensive View of Crypto

Despite its limitations, market capitalization remains one of cryptocurrency’s most important and informative metrics. It can be a key indicator of market stability and popularity in ways that USD coin values can’t show.

When used alongside other tools, traders can benefit from gaining a more comprehensive understanding of assets and the market as a whole. In an industry as unpredictable as crypto, these added insights can go a long way for investors.