Leon Neal

Intro & Thesis

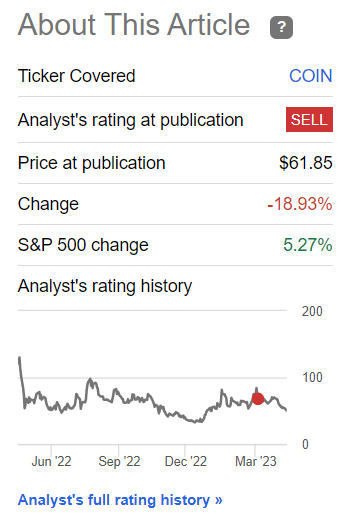

You are reading my second article on Coinbase Global, Inc. (NASDAQ:COIN) – the first one came out back in March 2023 when 1 share was trading at over $61. Since then, the S&P 500 Index (SPX) is up 5.27%; and the COIN stock is down ~19% – almost exactly as I predicted in the March article.

Seeking Alpha, my previous take on COIN stock

Unfortunately for those who anticipate the company’s significant resurgence to its prior price peaks of over $350 per share, my analysis of COIN’s earnings expectations and regulatory concerns with the Securities Exchange Commission [SEC] obliges me to reassert my previous Sell rating in advance of the upcoming quarterly report, slated for May 4, 2023.

Why Do I Think So?

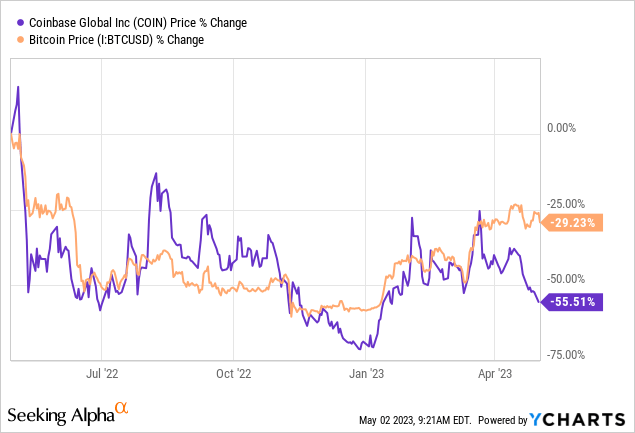

At first glance, one might think that the stock of COIN should follow the behavior of Bitcoin (BTC-USD) since this is its underlying asset. In fact, at some point in the past, the prices of the two instruments moved almost identically, and recently COIN began to move away from BTC, creating a kind of arbitrage:

In my opinion, this arbitrage is as illusory as the relationship between the dynamics of a single mining company and the underlying metal price, or the quotations of oil and gas companies with the evolution of oil and gas prices. Yes, it’s obvious that there is an impact – but the dynamics of the underlying asset need not be reflected in the dynamics of the stock. That’s because a) other driving forces could put pressure on financials, and b) stocks absorb market expectations and adjust when those expectations change. That’s why they say “something is already priced in,” meaning that a particular event is already reflected in the company’s stock price and that in the future it will either have to justify that event [expectation] or provide a new catalyst for growth to continue to grow.

In the case of COIN, the picture is rather unclear. Back on Jul 21, 2022, the company ran into trouble with the regulator, represented by SEC, which at the time accused then Coinbase employee Ishan Wahi of raking in at least $1.1 million in illicit profits along with his brother Nikhil Wahi and a close friend by using non-public information related to crypto exchange announcements. Then SEC started to investigate Coinbase Global over allegations that it allowed the trading of virtual assets that should have been classified as securities. The SEC was also looking into allegations of insider trading and claims that several crypto-tokens were unregistered securities.

Back in March 2023, the SEC issued a Wells notice to Coinbase warning the exchange that it may have violated U.S. securities laws. However, Coinbase has stated that the notice will not result in any changes to its current products or services.

In late April 2023, Coinbase filed a lawsuit in federal court, asking the SEC to respond to its July 2022 petition for guidance to the crypto industry through the formal rulemaking process. The regulator is required by the Administrative Procedure Act to respond to rulemaking petitions within a reasonable time. Coinbase’s Chief Legal Officer stated that if the SEC denies its petition, Coinbase would challenge that decision in court.

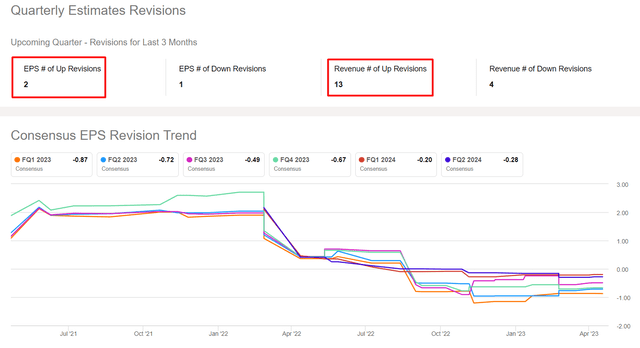

And in light of recent events, COIN has seen a large number of earnings revisions in the last 3 months – especially in quarterly sales numbers:

Seeking Alpha, COIN, author’s notes

I don’t want to sound negative, but while I support the idea of a company fighting for its interests in court, even against regulators, there’s an important detail to consider. Coinbase may not be acting in the best interests of its shareholders by doing so. For one, legal battles are expensive, and any prolonged lawsuit at such a high level could worsen COIN’s financial situation, which is already poor. Additionally, the risks associated with regulation are increasing rapidly. Why not just comply with regulatory requirements instead of trying to prove a point? In my opinion, instead of suing the SEC, COIN would have been better off taking more time to comply and prevent such situations from happening again in the future.

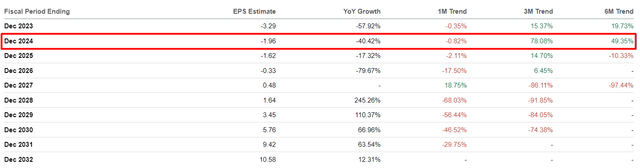

Back to what’s “priced in”. Certainly, the risks I have described have been partially factored into forecasts of COIN’s EPS numbers for a few years ahead – many values fell by mid-single-digit percentages in the last month. Earnings revisions continued to decline, as I expected at the end of March. However, if we move away to a 3-month time frame, we will find that some EPS forecasts are many times higher today than they were in the past:

Seeking Alpha, COIN, author’s notes

The outlook for the full-year numbers is even better now. For example, FY2024 EPS is 49.35% higher today than 6 months ago:

Seeking Alpha, COIN, author’s notes

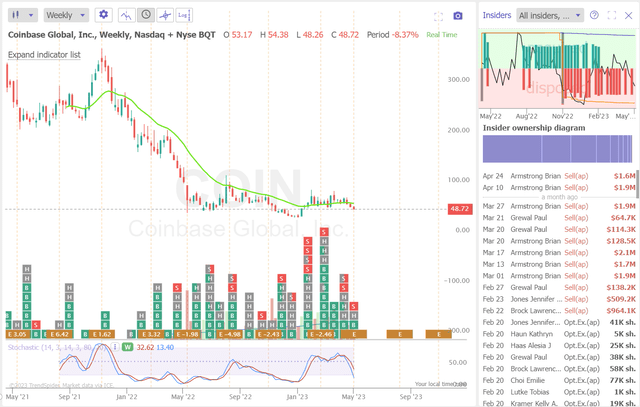

From what we read in most bank reports, analysts are relatively bullish on Coinbase’s long-term prospects – in Q4 2022, only 1 analyst [Jeff Cantwell from Well Fargo] reaffirmed his “sell” rating, while the other 11 analysts were either neutral or bullish [not counting those who did not change the old “sell” call – Dan Dolev from Mizuho, for example]. And at the same time, insiders were mercilessly getting rid of their stakes in the company:

TrendSpider Software, author’s notes

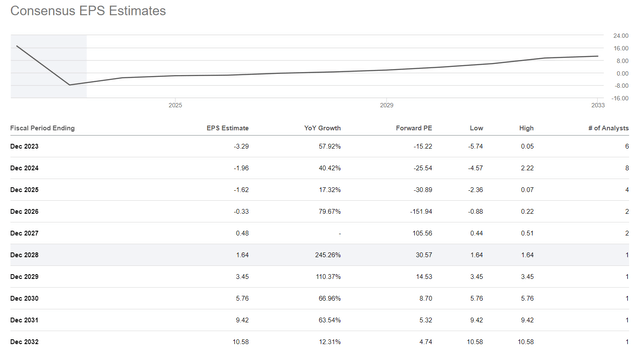

If we convert the current EPS forecasts into implied P/E ratios, we will find that COIN will not be generating a positive bottom line until the end of FY2027 and the current valuation with a P/E of ~30x in FY2028 looks too unsustainable, in my opinion:

Expectations are clouded by the fact that the above forecasts beyond FY2027 are based on the opinion of only 1 analyst – i.e. the consensus consists of only 1 opinion, which in my opinion leads to overly optimistic expectations that cannot keep up with reality when it comes.

I assume that the number of shares outstanding will continue to rise steadily as the company continues to generate losses and has to finance itself somehow. The level of debt has been relatively stable in recent quarters, which means that there will most likely be a dilution as a source of needed funds.

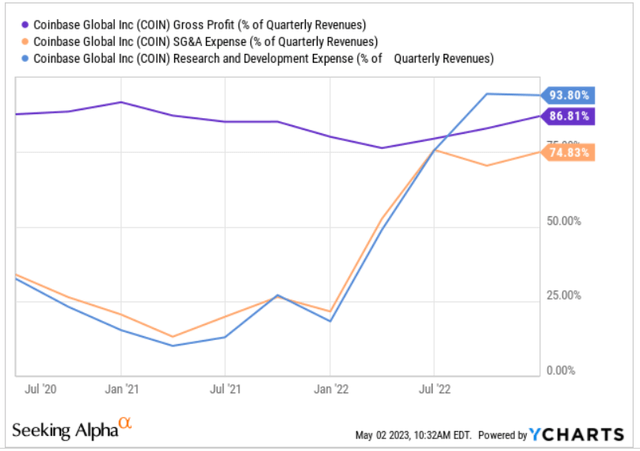

Competition with Binance and other major peers is set to escalate, and the problems with SEC and the way COIN is responding to them, trying to respond forcefully to regulatory enforcement actions should inevitably lead to relatively high operating expenses [OPEX] and one-time expenses. Speaking of OPEX – COIN has long had a problem with cost management – SG&A and R&D spending are growing in absolute terms, as they should, but revenue growth is clearly not keeping pace. COIN has been spending much more recently to cover costs of sales [COGS], signaling to the market that its breakeven is likely even further away unless new levers are found to increase the top line.

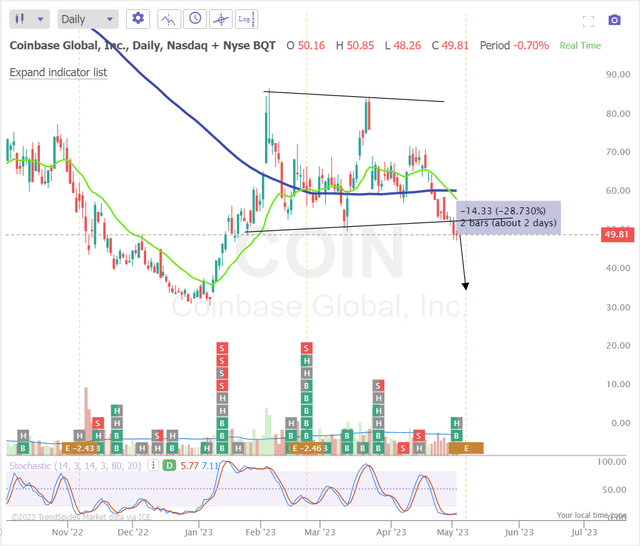

Technical analysis is also not going well for COIN ahead of the Q1 2023 quarterly report: the stock has broken a strong support zone and is moving lower. If the report is weak or forecasts are not as positive as most analysts expect [this is my base case scenario], COIN stock is likely to fall back to its prior supporting lows in the $35-40 per share range, which is more than 25% below current levels:

TrendSpider Software, author’s notes

The Bottom Line

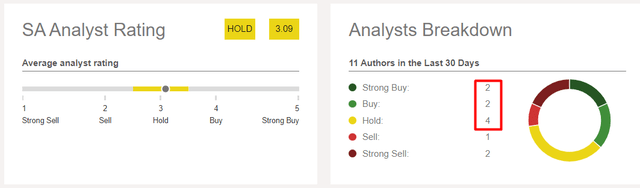

Admittedly, there is a chance that my analysis of COIN is incorrect. It’s worth noting that there are many other SA analysts who are fans of the company – take a look at their reports if you make due diligence on the stock:

Seeking Alpha Ratings for COIN, author’s notes

Perhaps all the negativity about COIN is already contained in the forecasts for several years of negative EPS figures. From a technical analysis perspective, this stock also looks heavily oversold (see the daily chart above).

However, despite these upside risks to my bearish thesis, I still believe that current expectations for COIN’s earnings over the next few years are too optimistic. The way the company is trying to solve the problem with the SEC by filing counterclaims does not solve the problems, but in my opinion, only exacerbates them. I reiterate my earlier sell recommendation and see a downside of at least 20-25% from current share price levels.

Thanks for reading!