byakkaya

Thesis Summary

ChainLink (LINK-USD) is a unique blockchain that builds a bridge between crypto and the real world. Its unique approach to oracles makes it an excellent great tool for smart contracts to facilitate value securely.

Given the initial rally we have seen in LINK, I believe that the following bull run LINK could exceed $80, giving this coin 10x return potential.

Technology

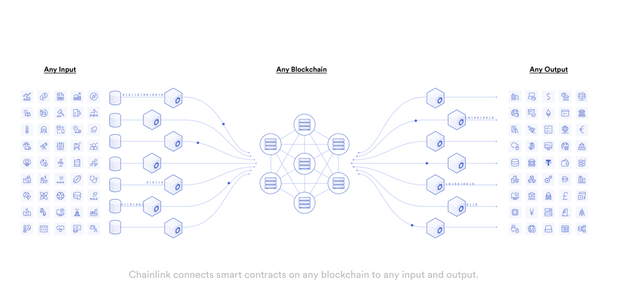

ChainLink is the first decentralized network of oracles. An oracle is the software that allows outside data to enter into a blockchain.

As we know, blockchains are secure due to their decentralized and immutable nature. They allow anyone to participate in the blockchain, and its data is stored and validated continuously.

However, blockchains face an obstacle when they try to expand beyond r own network. This is usually done through smart contracts, which are applications that leverage the power of the blockchain. But these applications sometimes rely on outside data. This is where oracles step in and where ChainLink changes the game.

Oracles are the vehicle through which outside data is introduced to blockchains. But if these oracles aren’t secure themselves, security breaches can occur. Oracles are traditionally centralized, but ChainLink provides a network of decentralized oracles that connect off-chain data to on-chain smart contracts.

ChainLink technology (blogs.chain.link)

There are three key components to ChainLink’s functioning; On-chain oracles, off-chain oracles and the ChainLink Node.

ChainLink’s on-chain oracles are smart contracts that connect requests for information with the appropriate off-chain oracles. These contracts serve to aggregate data, check the reputation of oracles and match the right requests.

Off-chain oracles are the ones responsible for feeding information to the blockchain. They are the equivalent to validators/miners in other blockchains. These oracles stake LINK to be able to act as oracles, and receive LINK in return for performing this service. ChainLink keeps oracles honest by validating data against each other and punishing oracles with the wrong data. It also sends information requests to numerous validators to ensure that it is accurate.

ChainLink is one of the most exciting blockchains because it really helps bring the utility of crypto to the real world, especially as we approach a more interconnected economy through the development of the Internet of Things.

Ecosystem

ChainLink has many different use cases, thanks to the way it leverages real-world data.

In the world of DeFi, LINK allows for the creation of more secure smart contracts that rely on real-world data like stock/crypto prices and yields. Granary is an example of this. A cross-chain lending platform that uses LINK.

Insurance is another use case for ChainLink. Blockchain technology can facilitate the handling of data that insurance companies need, and ChainLink can provide accurate and timely real world-information. Ensuro is doing this right now.

And it is also worth mentioning that ChainLink can be used as a bridge between traditional systems and the blockchain. LINK can connect to any blockchain, and this can be used by data providers, websites, networks etc.

Tokenomics

The LINK token is used as a reward to pay LINK oracles. At the same time, these oracles have to stake LINK in order to show their commitment to the network and be able to act as oracles.

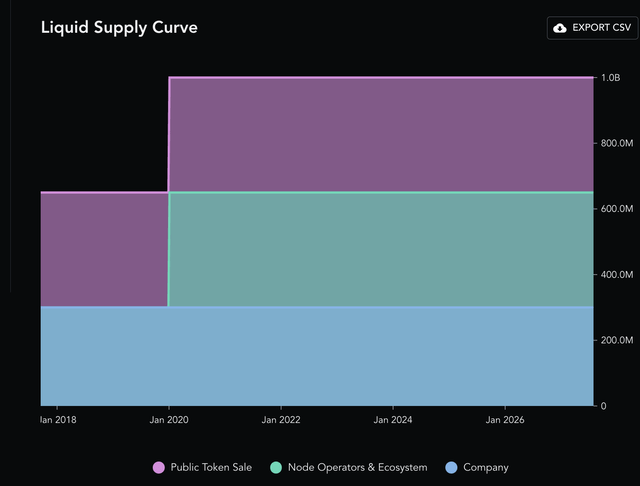

The good thing about LINK is that its supply is capped at 1 billion tokens:

Supply Schedule (Messari)

This makes LINK an ideal investment, as it has a limited supply, but it serves a growing market with numerous use cases, meaning its demand should increase in the future.

Price Forecast

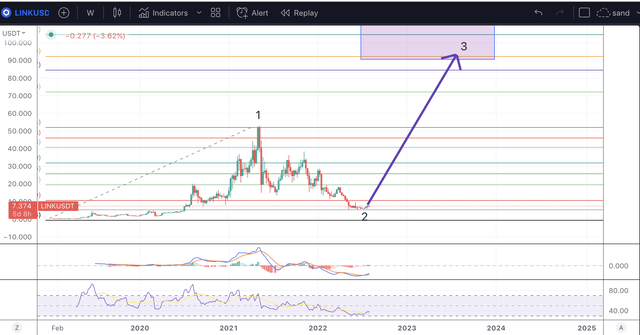

On a fundamental level, LINK has some very interesting applications. On a technical level, I also see evidence that the price could explode soon.

Price Forecast (Author’s work)

Using Elliott Wave Theory, I predict that LINK could reach a target price of over $80. The rally we saw take place in 2021 was wave 1, and we have now corrected in wave 2, which went all the way down to the 88.7% retracement. Over the last few weeks, we have seen a strong reversal. Furthermore, the weekly MACD has done a bullish crossover, and the RSI looks ready to climb higher too.

While such an increase seems extreme, even for a cryptocurrency, consider that there are compelling arguments beyond EWT that support this price target.

The Global IoT market is projected to grow at a CAGR of 26.4% annually from here to 2029. If we were to assume a similar growth rate for ChainLink and translate this to the token’s price appreciation, then LINK could be worth around $80 by that time.

Also, we must consider the fact that LINK was already trading at nearly $60 at the height of the crypto bull market. When the crypto cycle reaches another peak, LINK should be significantly above this level.

With this technology, it may take a while, but the potential for high returns is there.

Risks

We must also consider that ChainLink, while a leader in this space now, has to deal with more competitors as this market grows. At the moment, there are other similar initiatives such as Band Protocol, API3, and WINKlink.

The future of cryptos is still unclear, and we still don’t know what the market will look like in 10 years. However, one good thing about ChainLink is that it is compatible with any blockchain, so even if the dominant blockchains change, LINK will be able to interact with them and provide value.

Takeaway

ChainLink is one of the largest cryptocurrencies today, and for good reason. There are 1000s of applications that use ChainLink every day. This blockchain really brings value to the real world, which in my book, makes it a strong contender to outperform in the coming crypto bull market.