ipopba/iStock via Getty Images

Thesis

Coinbase (NASDAQ:COIN) has had a turbulent ride since its IPO in April of last year. With cryptocurrencies still riddled with speculation, the stock is down roughly 61% from its listing price. At current price levels, the stock has become too cheap to ignore. Coinbase’s financials look strong, and there are several qualitative aspects granting a promising outlook for the company. Let’s take a look.

(Note: All financial data was sourced from ycharts.com and Coinbase’s FY21 annual report.)

The macro-outlook for Coinbase looks promising, here’s why

Much of Coinbase’s shortfalls are tied to the speculation surrounding cryptocurrencies in general. However, last month, President Biden passed an executive order prompting financial regulators to work on the integration and regulation of cryptocurrencies. This comes as a big win for crypto advocates as many investors have avoided cryptocurrencies with concerns over the lack of regulation. Cryptocurrencies have been used to facilitate numerous illicit activities, such as money laundering, trafficking, tax evasion, and theft. Not to mention the amount of money that has been lost because of lost passwords, seed phrases, and keys. With government regulation, concerns will begin to taper, making crypto investments more attractive to those that wouldn’t touch previously. This bodes well for active crypto investors, prospective crypto investors, and Coinbase’s business.

While the highly volatile nature of cryptocurrencies will continue to keep investors on the sidelines, regulation should help in reducing volatility. Additionally, from a Coinbase investor standpoint, volatility is a good thing for the company’s bottom line. High volatility means there is a lot of capital movement in and out of various cryptocurrencies. Coinbase generates revenue from facilitating the trades made on its platform. With high volatility, there is much fear and greed; with fear and greed comes more trades and higher volume. High volatility isn’t for a lot of investors, however, if you want to capitalize on the nature of the crypto market without being in it, invest in Coinbase.

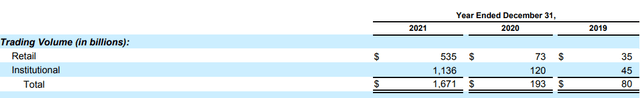

According to Coinbase’s FY21 annual report, roughly 68% of trading volume is derived from institutional investors. Trading volume from retail investors in FY21 came in at $535 billion, with $1,136 billion coming from institutional investors. This is a promising characteristic to see as ‘big money’ is heavily involved in the cryptocurrency market. If you’ve heard the phrase ‘follow the money,’ the majority of the money flowing in and out of Coinbase is institutional capital. As investors see institutional willingness to pour billion into the crypto market, they will slowly become more willing themselves. The figures from FY21 also reflect institutional involvement in the crypto market before Biden’s executive order was passed.

Coinbase’s Institutional vs. Retail Volume (investor.coinbase.com/financials/sec-filings/default.aspx)

In short, macro-outlook for Coinbase is strong. The government is getting on board with solidifying the validity of cryptocurrencies and their existence. The highly volatile nature of the crypto market is good for Coinbase’s bottom line, as high volatility is a result of high volume. Institutions are heavily involved in the crypto market, demonstrating that ‘big money’ believes there is value to be invested in. I find all of these aspects to be very promising for Coinbase as the crypto market continues to develop.

Coinbase’s stock is too cheap to ignore at current market levels

Let’s look at some of Coinbase’s valuation metrics to get a grasp on how cheap the stock is trading for compared to earnings and free cash flow. Coinbase’s FY21 EPS came in at $14.50 with free cash flow per share coming in at $48.39. This represents a P/E ratio of 9.86 and a P/FCF ratio of 2.63 based on the current market price. Considering most emerging tech companies with promising growth prospects have been seen trading with these ratios well above 50 it doesn’t make sense for Coinbase to be as undervalued as it is. The reason lies in the speculation surrounding the crypto market. I find this as a temporary opportunity to buy heavily discounted shares.

Now let’s look at other cash flow figures. Coinbase’s FY21 cash from investing came in at ($1.125) billion, up over 2,000% from FY20. Coinbase’s FY21 return on invested capital came in at 67.55%, with its weighted average cost of capital coming in at 8.21%. This shows Coinbase is investing significantly in growing its business and is returning over 8x on the cost of its invested capital. We can see this with cash from operations growth, as FY21 cash from operations came in at $10.73 billion, up 257% from FY20.

A quick check of the balance sheet gives no room for concern either. Coinbase’s FY21 debt-to-equity ratio is 0.53, quite reasonable considering the company is coming off a year with a 2,000% jump in investment activities. The company’s cash on hand in FY21 came in at $7.224 billion, and shareholders’ equity came in at $6.382 billion. The P/B ratio is sitting a 4.42, which I also consider quite low considering Coinbase is a newly public, tech company in an emerging market. It’s worth noting that FY21 cash on hand is up 550% from FY20 and FY21 shareholders’ equity is up 562% from FY20. Coinbase’s balance sheet is extremely strong, and cash and shareholder equity are growing rapidly.

I personally find P/E ratios of 15 and F/FCF ratios of 20 to fair value ratios for most companies. As seen with newer tech companies, these ratios can well exceed 50. However, if we were to use 15 and 20, respectively, Coinbase is significantly undervalued at current market levels. A P/E ratio of 15 would give Coinbase a fair market value of $217.5 per share. A P/FCF ratio of 20 would give Coinbase a fair market value of $967.80 per share. The far lower P/E value represents that Coinbase is roughly 41% undervalued. However, as many investors would agree, free cash flow is far more important than earnings. On a free cash flow basis, Coinbase is trading 86% below a fair market value. I personally believe Coinbase should be trading in the area of $300 per share.

Coinbase’s operational growth is impressive

I will quickly point out Coinbase’s net income and volume growth between FY21 and FY20. The company’s FY21 net income came in at $3.624 billion, up 1,025% from FY20. The volume for FY21 came in at $1,671 billion, up 766% from FY20. This shows that Coinbase is obviously experiencing exceptional growth, and that revenue growth outpaced volume growth. These are both exceptional aspects from an investor standpoint.

Risks associated with an investment in Coinbase

The first risk associated with Coinbase would be shortcomings in government regulation. Should the government decide it’s not in its best interest to integrate cryptocurrencies, many investors may continue to stay clear of the market. Any bans on crypto would be particularly detrimental. While the current trajectory of the crypto market and Coinbase is positive, these developments must be closely monitored. Lack of regulation will likely lead to mitigated growth potential, while crypto bans could lead to something as significant as a delisting.

Another risk is competition. Coinbase has strong competition in the likes of Binance U.S. (BNB-USD), eToro, and Crypto.com. While Coinbase is like the Apple of crypto exchanges in terms of its user-friendly platform, it is also notorious for higher fees. Coinbase’s competitors are continually making improvements to features and user-friendliness. Coinbase is currently the only publicly listed crypto exchange, giving it an advantage in terms of market presence. However, as the crypto market continues to develop, competition will become more aggressive. This can and will likely force Coinbase to become more competitive with fee structures, thus, hurting its bottom line.

A shorter-term risk to consider is inflation. As consumer budgets tighten, they may begin selling their crypto assets for extra cash. In tandem, we will likely see reduced volume and trades as consumers may not have expendable funds to trade with. This will reduce overall volume, trades, and revenue for Coinbase. While I believe this is a temporary setback, it’s the economic environment we’re in now.

Conclusion

In conclusion, I am bullish on Coinbase at current market levels. The overall macro-outlook for Coinbase is promising. Meanwhile, earnings, cash flows, and valuation all look attractive as the stock is down over 60% from its IPO last year. Additionally, the balance sheet is strong, and growth is impressive. I don’t see the outlined risks being detrimental to Coinbase so long as regulatory efforts continue and no bans ensue. The stock appears significantly undervalued at current market levels and is worth consideration.