Urupong/iStock via Getty Images

Editor’s note: Seeking Alpha is proud to welcome Cryptonomics as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Investment Thesis

The market is expecting a repeat of the lackluster Q3’21 for Q4’21 of Coinbase (COIN) and we project that Q4’21 will be the best quarter of the year beating Q2’21 by ~25% and Q3 by ~115%. The upcoming NFT Platform will add to the flywheel effect and accelerate revenue growth in 2022.

By using a portion of its vast profits to reinvest into Coinbase Ventures, COIN is positioning itself to be a one-stop-shop and on/off ramp for anything and everything crypto and web 3.0 – otherwise known as a Super App. Coinbase Banking has started offering interest-bearing accounts on crypto and Borrow/Lend services which earn Coinbase high interest revenue on safe over-collateralized loans.

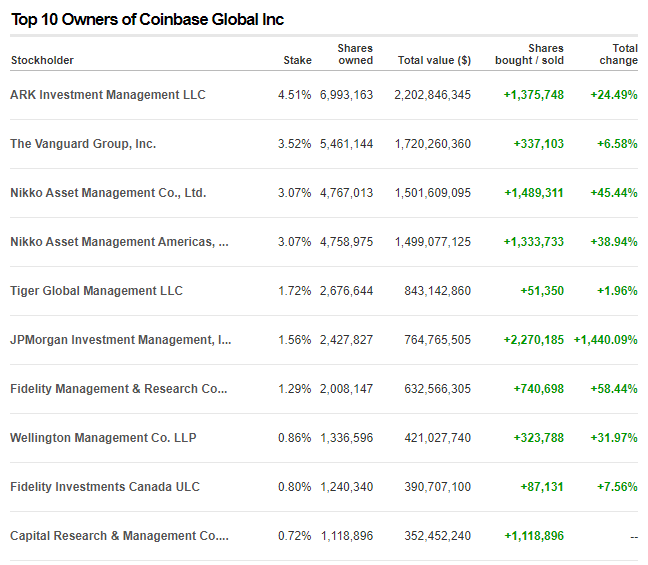

The long-awaited institutional horde is finally here. Coinbase has over 7,000 institutional customers, including hedge funds, financial institutions and corporations. Coinbase also has an impressive list of the top 10 institutional investors such as ARK Invest.

Rain or shine, every minute of every day Coinbase makes money, because it is a 24/7 market that doesn’t close or take breaks, and every single transaction adds to their bottom line.

Remember: “To make money in stocks you must have the vision to see them, the courage to buy them and the patience to hold them. Patience is the rarest of the three.” – Thomas Phelps

Backdrop

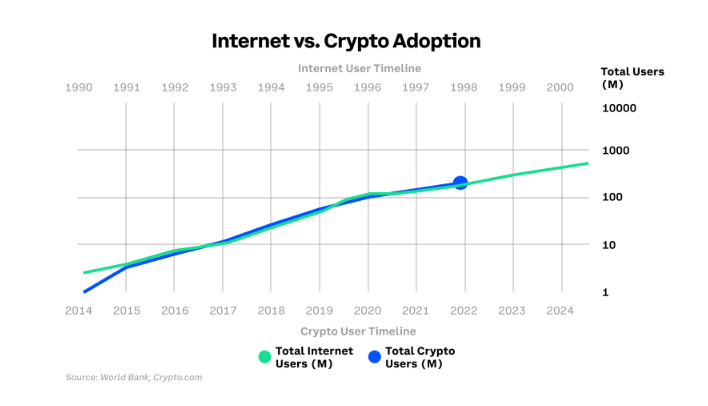

Total crypto market capitalization at the end of Q4’21 was about $2.2 trillion, up from about $800 billion at the end of 2020. According to the World Bank and crypto.com, the number of crypto users globally has 2X’ed in the first half of 2021 to over 200 million – and the rate of user growth is accelerating. The crypto adoption curve is mirroring that of Internet adoption over the first decade, beginning in the late 1990s. Looking at the growth path we can expect the number of crypto users to hit ~ 1 Billion in ~ 2-3 years.

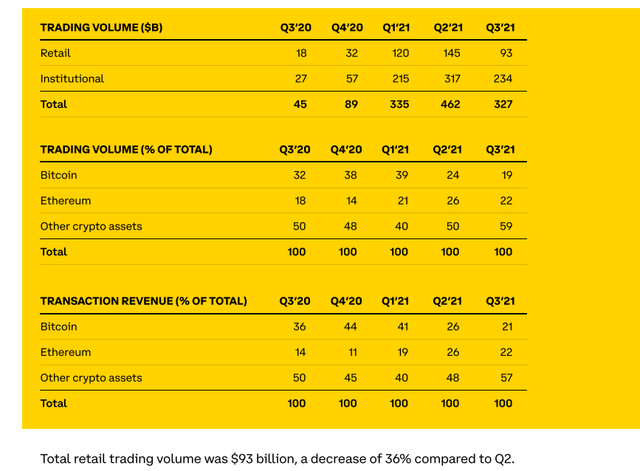

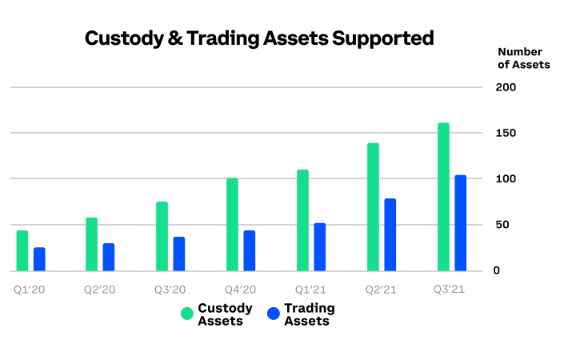

Source: Coinbase-Q321-Shareholder-Letter

In expectation of the 1 Billion users, Coinbase is investing heavily towards the future through their growth flywheel by: growing user base, adding breadth and depth of assets, and launching innovative products and services like NFTs and lending.

What Story Are Coinbase’s Three Earnings Reports Telling Us?

In my experience, when it comes to newly IPO’ed companies, it is best practice to start a small position after the second earnings reports (ER) or 6 months, after the Lockup period has ended and the insiders have had a chance to sell their shares. I like to add slowly to my position after the third earnings report – because two points make a line, but a third data point tells a story. So what story are Coinbase’s three ER data points telling us? Based on our projections the three data points are the epitome of an unreliable narrator.

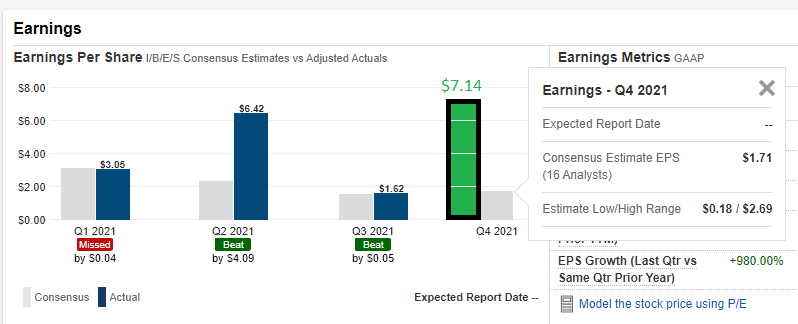

2021 Q1-Q3 results and Q4’21 projections

- Q1 2021 was a close miss at $3.05 EPS

- Q2 2021 was a blow out Beat at $6.42 EPS beating the consensus estimate by + $4.09 or +175%

- Q3 2021 was a close beat at $1.62 beating the consensus by + $0.05, but a drastic slowdown in revenue from Q2

- Q4 2021 the consensus estimate is $1.71 which is not far from Q3 and this is where the plot thickens!

Source: Fidelity.com

Our Q4’21 estimates are implying a considerable beat! Using our model we estimate that Coinbase’s Q4’21 EPS will be ~ $7.14 (green bar) assuming a similar operating expense as Q3’21. This would imply a +317% or +$5.43 EPS beat of the $1.71 consensus estimate, and more importantly, it is very much an out of consensus call.

“You can’t make money agreeing with the consensus view” – RAY DALIO

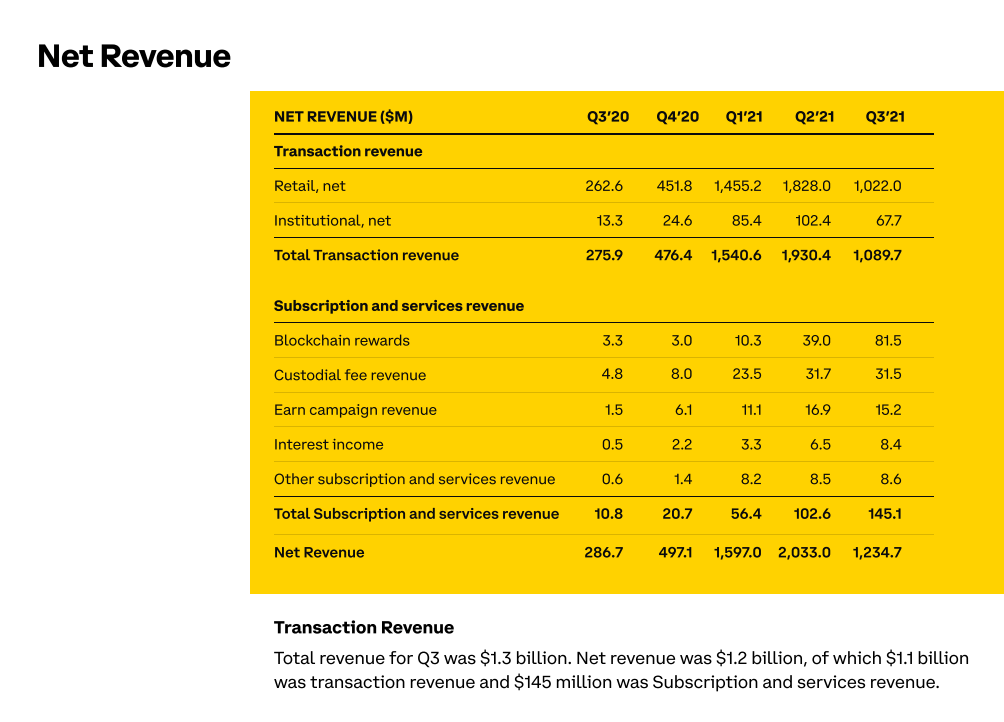

Source: Coinbase-Q321-Shareholder-Letter

Model Methodology

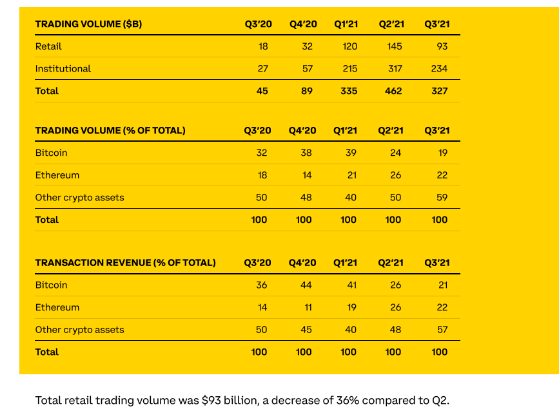

We estimated Q4’21 transactions volume to be $537B by aggregating daily volume on Coinbase Pro. Then we calculated the revenue from fees at ~ 0.40% to be ~$2.2B ($537B X 0.40%). We calculated the average trading fee of the last three quarters to be ~0.40% which is also based on the customer mix (retail/institutional) and maker/taker fee structure of Coinbase’s trading fees rules. Then we added in ~$200M of subscription and service (S&S) revenue based on the past three quarters subscription revenue and growth. S&S was $145M in Q3 and grew by 42% from prior Q2. S&S revenue is mostly blockchain rewards and custodial fees. Assuming similar growth rate for Q4 we calculate ~200M of total S&S revenue.

With these estimates and assumptions, we project Coinbase Q4’21 revenue will come in between $2.35 – 2.55 billion, implying a ~25% better revenue than the Q2’21 of $2.033B and a ~ 115% greater revenue than Q3’21 of $1.2347B. We estimate ~ $7.4B net revenue and ~$7.7B total revenue for 2021 using the same calculations.

Source: Coinbase-Q321-Shareholder-Letter

Stats

COIN has a P/E ratio of 20.29 which is very reasonable for a fast-growing tech company and PEG Ratio of 0.30. PEG ratios lower than 1 are considered good, indicating a stock is undervalued. The Gross Margin is at 77% and Operating Margin 42.2% and the Return on Equity (ROE) is 89.7%. Coinbase has 55 million total Users and 8.8 million monthly active users (MAU). When considering the large margins and the ROE with the rate of growth and the number of users, we can easily make an argument that COIN is undervalued. The market may believe the growth is unsustainable, but if our projections for Q4 are correct it will demonstrate continued and accelerating growth further validating the undervalued thesis.

NFTs: Revenue Growth Catalyst For 2022

Coinbase recently announced that they are launching Coinbase NFT, a new product experience where users can mint, collect, discover and showcase their NFTs, all in one place. An NFT, or non-fungible token, is a tokenized version of a real-world item (such as art, music, or exclusive membership to an online space) that can be bought, sold, and validated on the blockchain. NFTs are an exciting new opportunity for creators in various mediums to share their work, and for users to engage directly with the creators. With Coinbase’s NFT platform coming soon and 2,656,825 people on the waitlist as of 12/29/21, there is a lot of potential revenue that will be realized in fees once it is live.

Ideally, Coinbase will make NFTs more accessible to the general public. By making NFT minting and trading more approachable to retail investors that may not be technically inclined to self-custody crypto and use web 3.0 dApps just yet, Coinbase stands to become the gateway to a whole new industry.

Quick definition detour:

Web 1 = Read only (think AOL).

Web 2 = Read & Write (Blogs, social media, comments) Google and FB own all the data.

Web 3 = Read, Write, own unique digital assets, users own the network, and their own data.

If the NFTs are denominated in crypto instead of US dollars, it will also cause a huge spike in retail trading volume since one would first need to purchase crypto in order to buy or mint an NFT. This flywheel will likely add substantial revenue to the bottom line and is not part of the bull thesis for Q4 results as the NFT platform is not live yet, but this will surely add tailwinds to revenue growth once launched in 2022 and this is not yet baked into the price by Mr. Market. The biggest NFT platform at the moment OpenSea, is valued at $13B, a market share Coinbase could eat away or even surpass with its NFT platform which could possibly add ~+20% to COIN’s current valuations.

Social Proof

One famous figure that is heavily weighted on COIN shares is Cathie Wood of ARK Invest. She is a well-known and respected investment figure who has built a large position in Coinbase. It is in fact the third largest position across all of ARK’s ETFs, and ARKK is the #1 institutional owner of Coinbase. Fun fact, you can sign up to get a daily email of ARK ETF trades and holdings for free, and Cathie does monthly webinars for free on YouTube, which are worth a watch.

Source: CNN

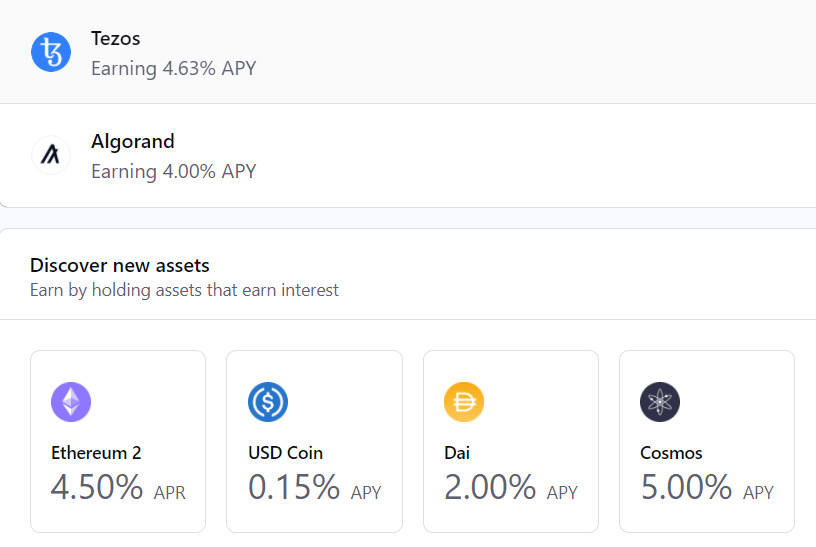

DeFi Yield & Staking

DeFi (Decentralized Finance) Yield enables Coinbase users to receive interest on their crypto-assets by depositing them into third-party DeFi protocols. Coinbase also offers “staking” to their customers. Staking is the process of actively participating in transaction validation, where anyone with a minimum-required balance of a specific cryptocurrency can validate transactions and earn staking rewards. Of course, Coinbase takes a healthy cut of the return for their facilitation of staking. The majority of their subscription revenue comes from blockchain rewards on staking protocols like ETH 2 where Coinbase takes ~15% of the profits in a revenue share program with their users. Users can earn up to 5% by staking their crypto assets in a Coinbase wallet. Another great product that offers value to Coinbase customers and adds ~$100M in revenue per quarter as of Q3 to the bottom line and growing about 40% per quarter.

Source: Coinbase.com

Asset Offering

Initially, Coinbase offered only Bitcoin (BTC-USD) on their platform and then they increased it to 4 crypto assets: BTC, Ethereum (ETH-USD), Litecoin (LTC-USD) and Ethereum Classic (ETC-USD). Now the platform offers 103+ assets for trading (30 new assets were added in Q3 alone) and 158 for custody. Each asset they add to their offering increases the total revenue. In recent months Coinbase has aggressively added popular retail coins including Meme coins such as Dogecoin (DOGE-USD) and Shiba Inu (SHIB-USD) that the retail investors seem to love. Meme coins were responsible for the large chunk of the Robinhood (HOOD) app revenue earlier this year. “Robinhood says dogecoin accounted for 62% of crypto revenue in Q2” and Crypto made up over 50% of transaction-based revenue in the second quarter.

Source: Coinbase-Q321-Shareholder-Letter

Coinbase Ventures

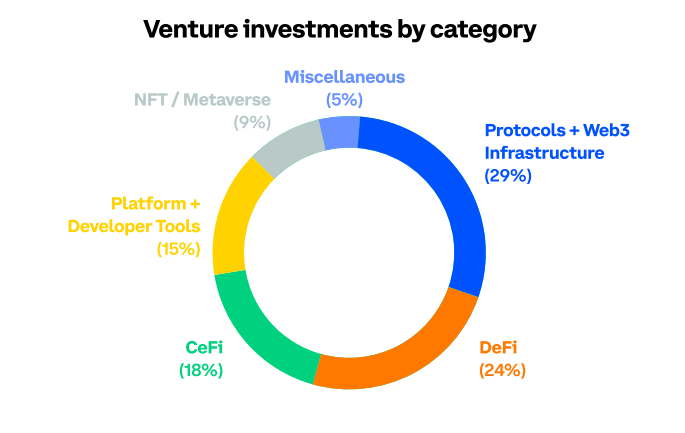

In order to stay competitive and on the cutting edge, Coinbase Ventures takes 10% of the company’s profits and invests what they believe will be the future. With a long-term view, this allows Coinbase to benefit as the broader crypto economy grows, as shown by their investments in companies like OpenSea, TaxBit, BlockFi, Uniswap, CoinSwitch Kuber, Messari, and their upcoming NFT platform and the new lending solution.

Source: Coinbase-Q321-Shareholder-Letter

Lending Platform/Bridge Loan

Coinbase has become a new type of a bank. A bank set to thrive in the web 3.0 world. Coinbase is now also a bank where you are able to take out a loan against your crypto as collateral. You can take up to 40% of the collateral value with 8% variable APR interest due monthly. This helps crypto investors use their crypto as collateral to purchase a big-ticket item or pay for an emergency expense without having to sell their BTC. This is beneficial in several ways. For one, you do not incur a tax liability when you borrow. This tax strategy has entered the news lately as it is the premier way the ultra-rich avoid paying taxes. Secondly, you get to hold on to your crypto investment at a time you might need emergency cash and you do not want to be forced to sell an asset like BTC that has historically since inception appreciated at a much greater rate than the 8% interest you would pay to borrow against it.

Source: https://www.coinbase.com/borrow

Bridge Loan

This loan program solves for some downsides in today’s banking system. When purchasing a home most banks will not account for your crypto assets when assessing your net worth or creditworthiness. I experienced this firsthand about a year ago when I was purchasing a home. This treatment of crypto assets by the legacy banking system can impede your approval for a home loan or the loan amount. If you have a sufficient amount of crypto you could take out a loan on Coinbase for the full amount of your home purchase and buy the home in cash. Once the home is yours, you can easily refinance it as now you are showing 100% equity and you can get the best and the lowest rate available and then pay back the Coinbase loan.

Crypto on the Balance Sheet

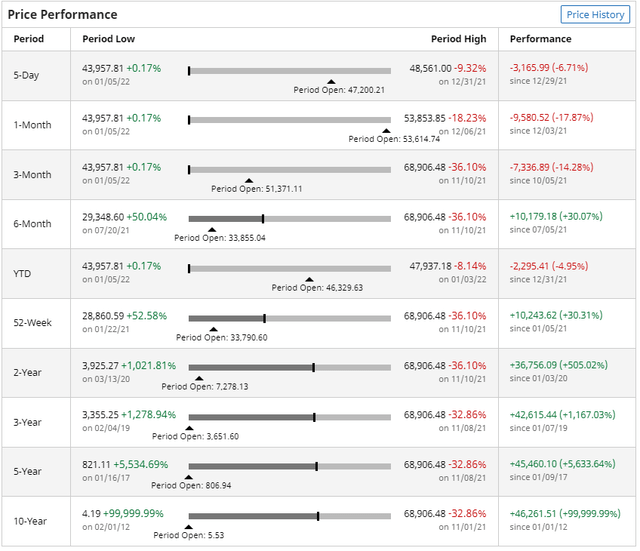

Coinbase has an operating cash flow of $9.89B (TTM) and they announced they will be converting $500M of their $6B of cash into crypto, following in the footsteps of the legendary Michael Saylor who has not only put his company’s MicroStrategy (MSTR) cash into BTC but also issued $2.2B dollars in corporate bonds to buy more BTC at almost every subsequent dip in BTC price.

Saylor argues that it is a great idea to borrow a billion dollars at 1% interest and invest in an asset like Bitcoin. Looking at past performance in the chart below for a 10 year period from 02/01/12 to 01/05/22 the rate of return (+99,999.99%) has been hard to beat by any other asset. Looking at even shorter timeframes the return is phenomenal. I urge our readers to look at 4-year time frames at minimum, given that inflation rate of BTC gets halved every 4 years in what is called “the halving” (a programed reduction of BTC block reward issuance to miners), that tends to cause a supply shock and be a catalyst for price appreciation historically. “I mean, if I could borrow $1 billion and buy Facebook a decade ago for 1% interest, I think I would’ve done quite well” Saylor said on “Squawk on the Street.”

Source: Barchart

I couldn’t agree more with Saylor’s logic and reasoning, and I suspect many other CEOs with cash-rich balance sheets are going to follow. Tesla (TSLA) was one of the first big companies to put $1.5 Billon of BTC on their balance sheet not too long ago. If other investment institutions and companies decide to add crypto to their balance sheets, Coinbase will be their go-to most trusted exchange and custodian that will benefit from this innovative shift in corporate treasury governance. For corporations interested in following Saylor’s and MSTR’s strategy, he has published a free guide on their website “Bitcoin Corporate Playbook.”

The Institutional Horde is Here

Institutional trading volume is greater than retail! A long-standing prediction and a meme in crypto have been “the institutional horde is coming” and Coinbase trading volume breakdown shows that the institutional volume is tending towards 70%. It is still very early and only a few institutions have dipped their toes in the crypto pool, but the whispers among investors are that large institutions are gearing up to deploy massive amounts of capital in 2022 pending board approvals to invest in this new $2.2 Trillion asset class.

Source: Coinbase-Q321-Shareholder-Letter

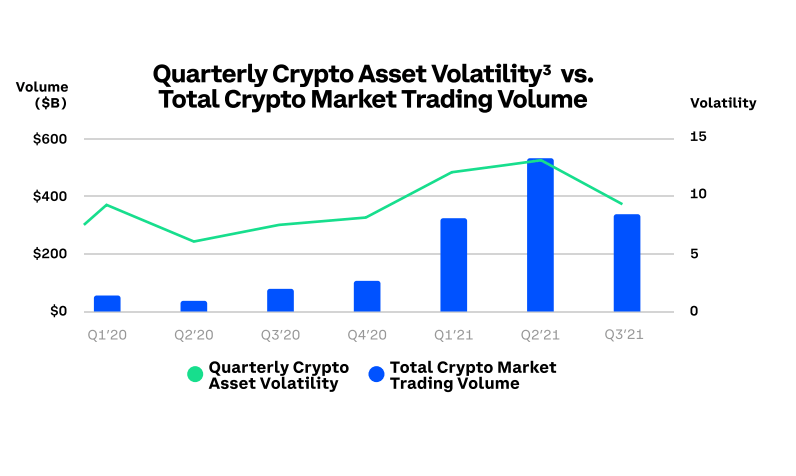

Volatility is Our Friend

In October, the total crypto market capitalization increased roughly 35% compared to the end of September and while crypto asset volatility remained elevated. By our projections, volatility and volume were greater in Q4’21 than in Q2’21, which means total revenue from fees will be greater than it was in Q2.

Volatility = Greater trading volume

So, if crypto prices fall slightly, it is not necessarily bad for COIN revenue. In fact, the volatility from a short-lived price decline, might and often does, cause more volume and thereby revenue for Coinbase.

Source: Coinbase-Q321-Shareholder-Letter

Risks

Before we recap the bull theses let us address the elephant in the room, the RISK. Crypto industry is very volatile both on its own and at the whims of regulators across the world. We must fully understand that earlier in the year as China banned Bitcoin mining and the prices fell by 50%. This level of volatility is not rare in crypto. The 2017-2018 bull market ended in a ~ 75% drawdown, which lasted 2 years, known as the crypto winter. There are also Smart Contracts that are the backbone of the decentralized finance ecosystem and any one of the big ones could possibly have a bug in the code that results in massive lost funds that could trigger a bear market. My biggest concern is the poor guidance for Q1’22 that may come if January is a lackluster month for crypto as a result of a crypto crash (a -50% decline in prices) prior to Q4’21 results coming out.

Shining Light

Even if January ends up subpar in terms of volume and volatility there is a shiny beacon for 2022 that will likely keep the bull run in crypto going strong as well as the bull theses for Coinbase and that is ETH 2. The long-awaited protocol switch on the Ethereum (ETH-USD) network (second largest crypto asset) from Proof of Work (POW) which uses lots of machines and electricity to validate transactions, to Proof of Stake (POS) which uses the crypto asset ETH itself for security instead of electricity, is slated for Q2-Q3’22. This may cause a blow of the top bull run and ETH might flip BTC as the #1 crypto, in what is called the Filippening. All of these possible outcomes are good for Coinbase as it will make a lot of revenue on transactions that grow with volatility.

Conclusion

Coinbase is positioning itself to be a super-app for web 3.0. Mr. Market might be underestimating Q4 results by a wide margin and failing to price in the upcoming NFT Platform which will add to the flywheel effect and accelerate revenue growth.