In the current days of high and sometimes absurd valuations, it can be a burdening task to find a company worthy of a long-term investment. Particularly, it’s difficult to find one that can provide significant upside, is a large cap stock, and generally has a high trading volume. Today, that stock is Coinbase Global, Inc. (COIN), as its price has dropped on par with Bitcoin’s since the company’s IPO mid-April. (See Coinbase stock charts on TipRanks)

Reporting on this growth potential is Owen Lau of Oppenheimer & Co., who expects Coinbase to post another record quarter when it reports, in about a month’s time. He ascribed COIN’s current success to trading volume of cryptocurrencies, high revenues, and growth in verified users.

Lau reiterated a Buy rating on the stock, and declared a new price target of $444. This reflects a potential 12-month upside of 74.89%.

The five-star analyst report was objectively optimistic on the stock, stating that the current share price is highly undervalued. He said that the price is showing signs of a compelling buy signal, for those willing to invest in the long-term.

The “crypto winter,” as Lau called it, does not bother him too much, as he sees multiple opportunities for further monetization by Coinbase. These include the introduction of physical card products, rewards for verified users, and the sentiment about bitcoin inevitably rebounding.

Although Bitcoin and COIN have both fallen significantly from their mid-April highs, Coinbase’s trading volumes increased about 36% quarter-over-quarter. That being said, year-over-year, the same metric has increased about 1,600%.

Lau expects management to steer away from its dependency on Bitcoin, as altcoins represented about 40% of trading volume in Q1. He suggests management may want to focus on recurring revenues from heavy users, as well as on mergers and acquisitions.

Due to the impressive growth seen in Coinbase, Lau raised his revenue estimate from $1.8 to $2.1 billion, and in congruence raised his price target from $434 to $444.

The global shift toward digital assets and their benefits may take a while, but Lau believes in its inevitability. Coinbase’s model, he says, “is well positioned to monetize this trend.”

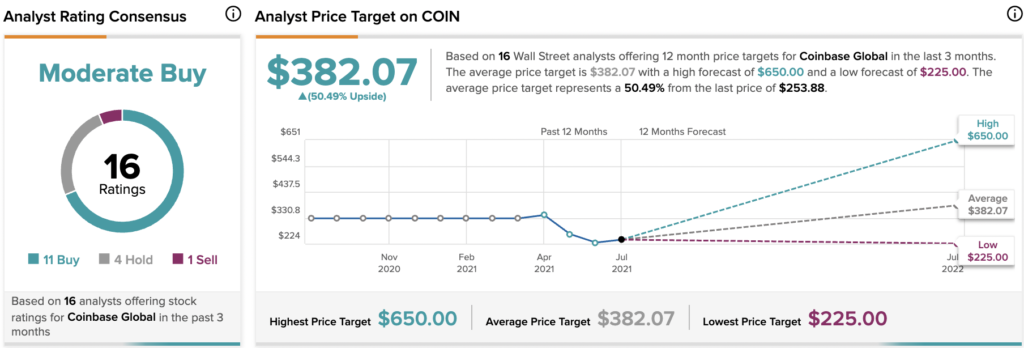

On TipRanks, COIN has an analyst rating consensus of Moderate Buy, based on 11 Buy and 4 Hold ratings, and 1 Sell rating. The average Coinbase price target is $382.07, representing a potential 12-month upside of 50.49%. COIN closed Friday trading at a price of $253.88 per share.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.